Explore key data insights with Xero analytics software

Forecast your cash flow, identify and compare trends, monitor key performance metrics, and decide on your next move with insights you can trust. Upgrade from Xero Analytics to Analytics Plus for your US small business.

A better understanding of your numbers

Analytics software helps make sense of your financial data. So with Xero Analytics, you always know how your business is performing.

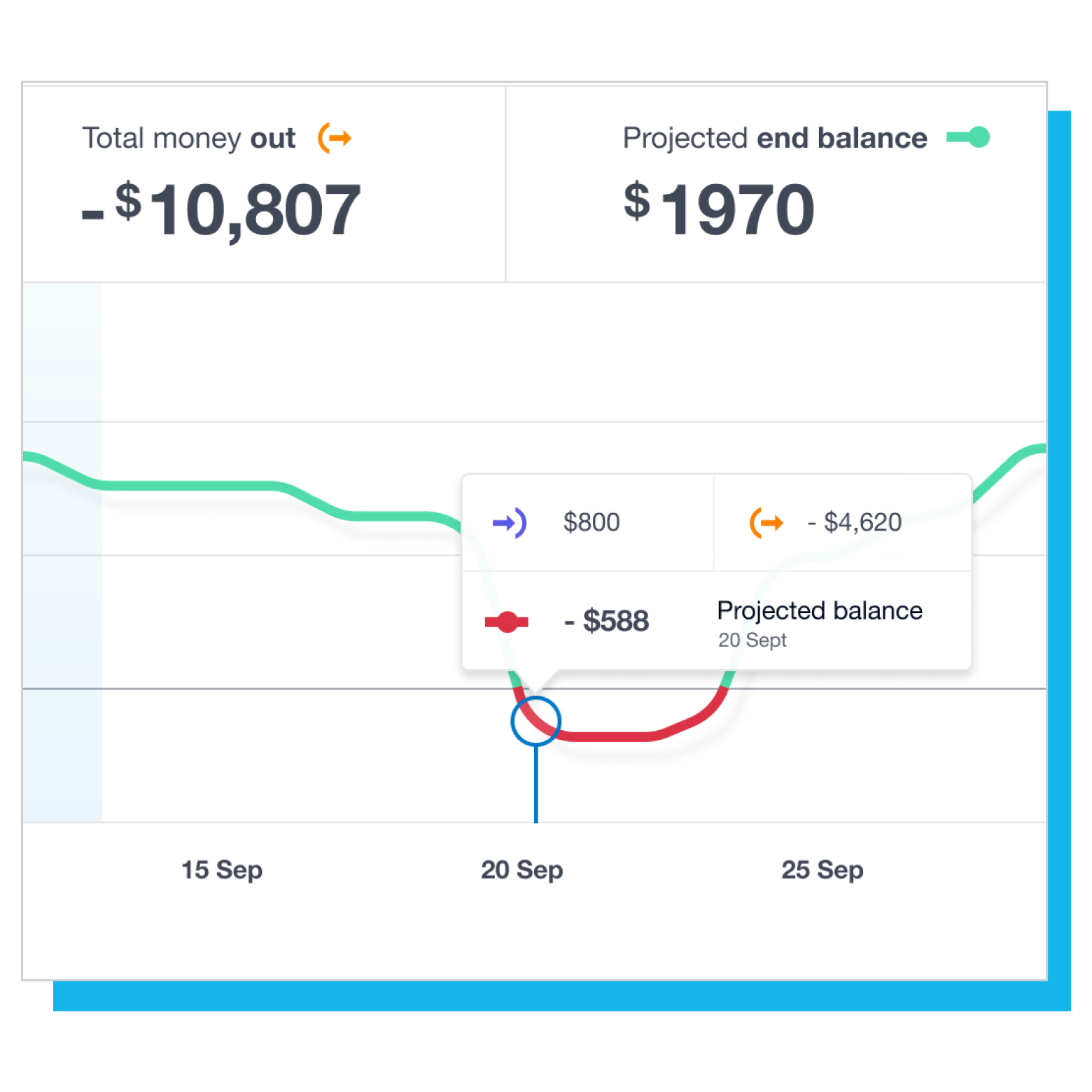

Easily track your cash flow

The short term cash flow provides real time projections on cash flow to help you plan ahead.

Check your financial health, your way

The business snapshot displays custom metrics so you can easily manage your latest expenses and track profitability.

Gain insights in real time

See up to date information that you can view with your advisor.

87% of customers agree Xero helps improve financial visibility

*Source: survey conducted by Xero of 271 small businesses in the US using Xero, May-June 2024

Easily track your cash flow with analytics

When do you pay that bill? Can you afford new equipment this month? Xero analytics shows you the cash moving in and out of your business bank accounts over a set period. You’ll replace guesswork with more informed spending decisions.

- See the effects of upcoming invoices and bills on your cash flow

- Quickly spot your most urgent bills to avoid any late payment fees

- Predict your future bank balance so you can plan your budgets and spending

Check your financial health, your way

Maybe you want to check your expenses this month. Or look at a graph of your profitability over the last quarter. The business snapshot dashboard is a snapshot of your business finances – no more sifting through data, just your core performance metrics at a glance.

- Track metrics like your monthly income and expenses to see how your business has been performing

- Identify trends in your data and better understand what affects your profitability

- Drill down into reports to get more-detailed information and insights into your business

Gain insights in real time

Simply your analytics by surfacing key insights all within Xero. Managing your invoices, bills and transactions in Xero, keeps your analytics always up to date.

- See your most important metrics on the dashboard whenever you want

- Work on the same up-to-date data as your financial advisor and collaborate more easily

- Get an overview of your financial performance without the complexities

Get Analytics Plus for deeper business insights

You can more confidently plan for your business’s future when you have a richer, more nuanced understanding of your data. Upgrade to Xero analytics plus for deeper customisations and advanced features that help you prepare for what’s next.

Xero analytics helps your small business

Xero’s data analytics simplifies the numbers for you.

Always know how your business is doing

Easy-access information and insights so you’re ready for any future business decision.

Make better decisions, faster

Clear, precise information saves your precious hours each week and gives you confidence in your finances.

Improve your operations every day

Become more efficient in your day-to-day operations and increase your productivity.

Take control of your numbers with Xero in the US

Xero accounting software turns complex data into the numbers you need to get on with your business. It automates tasks like bookkeeping and bank reconciliation, simplifies your invoicing, and gives you key insights to help you manage your finances.

Learn more about Xero cloud-based software

Read Hunt and Gather’s storyWe can see how the business is tracking

FAQs on analytics software and Xero analytics plus

This feature helps you make sense of large amounts of information that your business collects over time. Data analysis software keeps your business performance top of mind , and highlights areas for improvement.

This feature helps you make sense of large amounts of information that your business collects over time. Data analysis software keeps your business performance top of mind , and highlights areas for improvement.

Regularly analyze your data to better understand what’s happening in your business. Which time of year is your most profitable? When do you need cash reserves? Use your answers to predict what’s likely in the future and to plan ahead.

Regularly analyze your data to better understand what’s happening in your business. Which time of year is your most profitable? When do you need cash reserves? Use your answers to predict what’s likely in the future and to plan ahead.

Analytics plus is available with the new version of Xero accounting software. It uses AI to give you detailed cash flow predictions up to 90 days ahead and empowers you to customize your dashboard for a better understanding of your business.

Analytics plus is available with the new version of Xero accounting software. It uses AI to give you detailed cash flow predictions up to 90 days ahead and empowers you to customize your dashboard for a better understanding of your business.

This analytics tool is available in two versions – Analytics and Analytics Plus. The Analytics version is included in all Xero business plans, and shows how upcoming bills and invoices could affect your future bank balance. Simply choose any bank account and switch between a 7- or 30-day view. With Analytics Plus, which is included in the Established plan. You’ll have access to technology that helps predict your future short term cash flow and get customized insights that provide better clarity about what lies ahead. This includes viewing extended 60- and 90-day forecasts, predicting future recurring cash transactions, forecasting recurring payments of bills and invoices (powered by AI), and doing basic scenario planning by adding or removing future events.

See how to track your cash flowThis analytics tool is available in two versions – Analytics and Analytics Plus. The Analytics version is included in all Xero business plans, and shows how upcoming bills and invoices could affect your future bank balance. Simply choose any bank account and switch between a 7- or 30-day view. With Analytics Plus, which is included in the Established plan. You’ll have access to technology that helps predict your future short term cash flow and get customized insights that provide better clarity about what lies ahead. This includes viewing extended 60- and 90-day forecasts, predicting future recurring cash transactions, forecasting recurring payments of bills and invoices (powered by AI), and doing basic scenario planning by adding or removing future events.

See how to track your cash flowPredictions are based on recurring cash transactions and are only available in Xero analytics plus. Xero analyzes your past cash transactions you’ve reconciled, invoices, and bills to find patterns and averages. AI then identifies patterns to predict your cash flow, giving you the full picture.

See how to make cash predictionsPredictions are based on recurring cash transactions and are only available in Xero analytics plus. Xero analyzes your past cash transactions you’ve reconciled, invoices, and bills to find patterns and averages. AI then identifies patterns to predict your cash flow, giving you the full picture.

See how to make cash predictionsYou can track your income, expenses, average time to get paid and to pay suppliers, your balance sheet, and cash balance – all from a single dashboard. And see graphs and other visual tools for a quick look at how your business is doing. With Analytics Plus, you can customize your dashboard to fit business needs and utilize additional features that help you find deeper insights. Such as options to customize the account codes selected, and use flexible date ranges for more choice of time periods.

See how to track financial metricsYou can track your income, expenses, average time to get paid and to pay suppliers, your balance sheet, and cash balance – all from a single dashboard. And see graphs and other visual tools for a quick look at how your business is doing. With Analytics Plus, you can customize your dashboard to fit business needs and utilize additional features that help you find deeper insights. Such as options to customize the account codes selected, and use flexible date ranges for more choice of time periods.

See how to track financial metrics

Start using Xero Analytics for free

Start tracking your business health with Xero Analytics. Available in all business plans at no cost.

Sign up for Analytics Plus

For deeper insights and greater customization, upgrade your plan to get Analytics Plus.

FAQs about Xero in the US

Yes, Xero’s reporting and analytics capabilities help you easily prepare and submit your returns so you never miss a deadline. Your numbers will be accurate and all stored in one secure place.

See tax information for businesses from the IRS.Yes, Xero’s reporting and analytics capabilities help you easily prepare and submit your returns so you never miss a deadline. Your numbers will be accurate and all stored in one secure place.

See tax information for businesses from the IRS.Yes – Xero partners with Gusto for a full-service payroll solution. Gusto saves you time on all aspects of your payroll – including calculating employee pay and deductions – thanks to its clever automations.

Check out payroll with GustoYes – Xero partners with Gusto for a full-service payroll solution. Gusto saves you time on all aspects of your payroll – including calculating employee pay and deductions – thanks to its clever automations.

Check out payroll with GustoThe best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the USA.

Check out the Xero App Store.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in the USA.

Check out the Xero App Store.