Pricing & fees for Stripe accounts

This page sets out the fees charged to Xero customers whose Stripe pricing and fees are managed by Xero. If you can see Xero’s branding when you log in to Stripe, this means your pricing and fees are managed by Xero. Stripe may charge you for fees not listed below and you can find details of Stripe's applicable direct charges on their website.

Xero Terms of Use have been updated to include Online Payments Terms, where applicable.

The pricing and fees set out below remain separate to your Xero monthly subscription fee, and are subject to change. These fees will be determined in accordance with the Online Payments Terms.

You can issue either partial or full refunds via Stripe. The payment processing fee from the original charge and any applicable currency conversion fees are not refundable.

Xero online payments: Stripe fees charged by Xero

Australia

Cards

- 1.7% + A$0.30 for domestic cards, GST inclusive.

- 3.5% + A$0.30 for international cards, GST inclusive.

Australia Foreign Exchange Fees

- + 2% for international cards if currency conversion is required, exclusive of GST

If you have a Stripe account in Australia and you have provided Stripe with an ABN that is registered for GST, Xero will not charge you GST. You should consider your own tax obligations on the fees, e.g. GST reverse charge.

Canada (exclusive of sales taxes)

Cards

- 2.9% + C$0.30 for domestic cards

- 3.7% + C$0.30 for international cards + 2% if currency conversion is required

Instant Payouts

- 1% of Instant Payouts volume, minimum fee of C$0.60

Klarna

Klarna payment options are currently only available to your customers based in Canada.

- 5.99% + C$0.30 fee applies for Klarna payment methods

- $20 fee applies for lost disputes

New Zealand (exclusive of GST)

Cards

- 2.7% + NZ$0.30 for domestic cards

- 3.7% + NZ$0.30 for international cards + 2% if currency conversion is required

Klarna

Klarna payment options are currently only available to your customers that are based in New Zealand.

- 4.99% + NZ$0.65 fee applies for Klarna payment methods

- $25 fee applies for lost disputes

UK (exclusive of VAT)

Cards

- 1.5% + 20p for standard UK domestic cards (including consumer cards issued by Visa and Mastercard, all cards issued by Discover, Diners Club, and UnionPay)

- 1.9% + 20p for premium UK domestic cards (including commercial, corporate, or business cards issued by Visa and Mastercard, and all cards issued by American Express)

- 2.5% + 20p for European Economic Area cards + 2% if currency conversion is required

- 3.25% + 20p for international cards + 2% if currency conversion is required

Instant Payouts

- 1% of Instant Payouts volume, minimum fee of 40p

Klarna

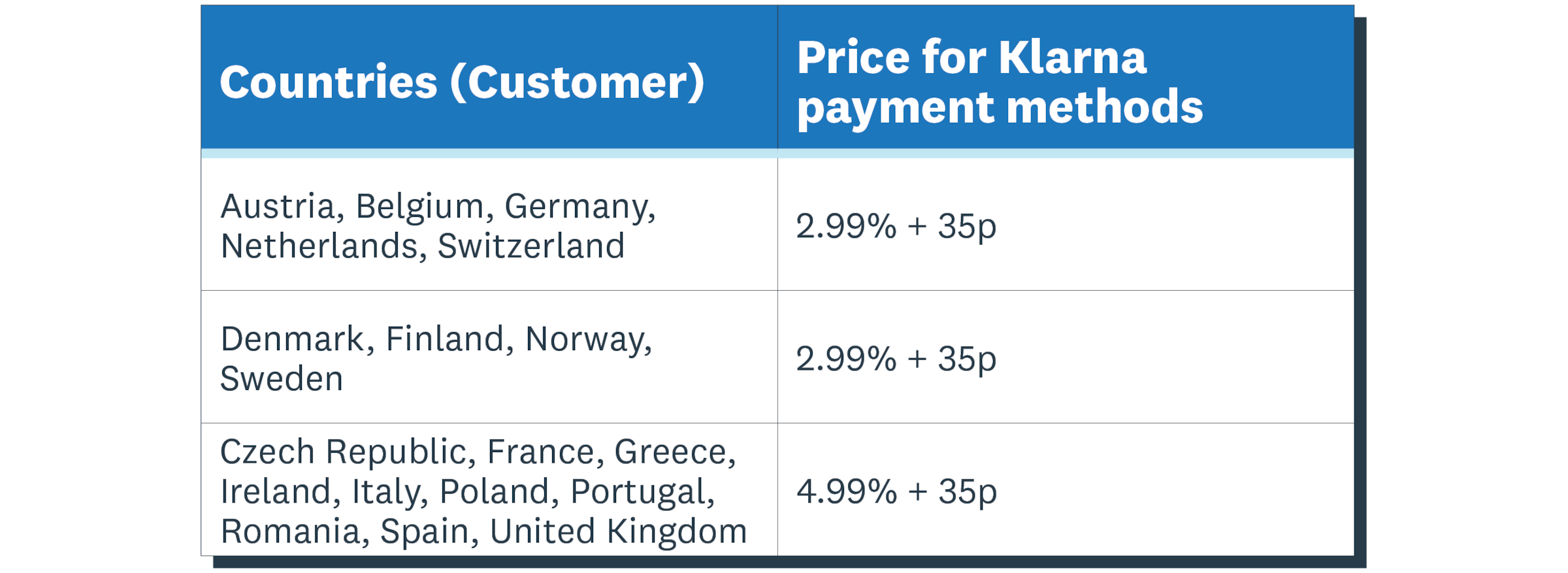

Klarna payment options vary in pricing and availability based on your customer’s country.

- 2% fee applies if currency conversion is required

- £20 fee applies for lost disputes

If you have a Stripe account in the UK, we aren’t required to charge VAT on our fees. If you are VAT-registered, you should consider your own tax obligations on the fees, e.g. VAT reverse charge.

US (exclusive of sales and local taxes)

Cards

- 2.9% + 30c for domestic cards

- 4.4% + 30c for international cards + 1% if currency conversion is required

Bank Transfer

- 0.5% capped at $5.00 per ACH credit transfer (50¢ fee per successful domestic refund)

- $15.00 per wire payment

ACH Credit Transfer (Legacy solution - no longer supported)

- $1.00 per ACH credit transfer

- $8.00 per wire payment

Instant Payouts

- 1.5% of Instant Payouts volume, minimum fee of 50c

Klarna

Klarna payment options are currently only available to your customers based in the United States.

- 5.99% + 30c fee applies for Klarna payment methods

- $15 fee applies for lost disputes

Xero in-person payments: Stripe fees charged by Xero

Australia

- 1.7% + A$0.25 per transaction for domestic cards, GST inclusive

- 3.5% + A$0.25 per transaction for international cards

Australia Foreign Exchange Fees

+ 2% per transaction for international cards if currency conversion is required, exclusive of GST.

If you have a Stripe account in Australia and you have provided Stripe with an ABN that is registered for GST, Xero will not charge you GST. You should consider your own tax obligations on the fees, e.g. GST reverse charge.

UK

- 1.4% + £0.20 per transaction for European Economic Area (EEA) cards

- 2.9% + £0.20 per transaction for non-EEA cards

How we bill:

Fees for Stripe are deducted from the payments processed, and users with negative balances will have fees withdrawn from their attached bank account. Users can add funds to their Stripe balance to avoid negative balances.

Need help?

For more information about our expanding partnership with Stripe, check out Xero Central. If you require further support about your pricing or fees, please raise a case and we’ll get back to you as quickly as possible.

All other general Stripe support enquiries will continue to be supported by Stripe, and can be accessed via the Stripe dashboard.

Important: Xero will never ask you to share your Stripe login details.