What is a gearing ratio and why it matters to your business

A gearing ratio is a financial metric that measures the balance between a business's debt and equity.

Published Thursday 3rd April 2025

Gearing ratio definition

In finance, gearing refers to the balance between debt and equity a company uses to fund its operations.

- Debt is borrowed money, such as loans and lines of credit, that must be repaid with interest.

- Equity is the owner’s investment in the business, including retained earnings and share capital.

What is a gearing ratio, then? It’s a financial metric that compares a business’s debt to its equity. It shows how reliant a company is on borrowed funds relative to its intrinsic worth, providing insight into financial health.

Lenders, investors, and stakeholders use gearing ratios to assess financial stability. A higher ratio signals greater reliance on debt, which means increased financial risk but also potential for higher returns. A lower ratio suggests a stronger equity position, reducing risk but potentially limiting growth opportunities.

Why does your gearing ratio matter?

Your gearing ratio is a key indicator of your business’s financial health. Tracking and managing it effectively helps you make smarter financial decisions and plan for sustainable growth.

- Borrowing decisions: Helps you judge whether you can take on more debt without straining your cash flow or increasing financial risk.

- Attracting investors and lenders: A balanced ratio signals financial stability, making your business more appealing to potential funders.

- Strategic planning: Aligns your debt-to-equity structure with your growth goals, whether aiming for rapid expansion or steady, low-risk growth.

- Cash flow stability: A lower ratio frees up more cash for reinvestment, while a higher ratio means more funds go toward debt repayments.

- Risk management: Regularly reviewing your ratio helps you spot financial vulnerabilities early and take corrective action.

Types of gearing ratios

Here are gearing ratios typically used by SMBs and their advisors to measure their financial leverage and risk. Each looks at different aspects of your business’s performance to help you look at your business’s financial stability and risk exposure from different perspectives.

- Debt-to-equity ratio: Compares total debt to total equity, showing how much of the business is funded by creditors versus owners. This is a key component of the gearing ratio, often used to assess financial leverage and risk.

- Debt-to-capital ratio: Measures the proportion of total capital (debt + equity) funded by debt. Higher ratios suggest greater reliance on borrowing.

- Equity ratio: Represents the share of total assets financed by equity. Higher ratios indicate stronger financial stability and lower risk.

- Times Interest Earned (TIE) ratio: Assesses your ability to cover interest payments with pre-tax earnings. A higher ratio reassures lenders that you can meet your debt obligations.

Debt to equity ratio vs gearing ratio

While the debt-to-equity and gearing ratios are often used interchangeably as both measure financial leverage, they serve slightly different purposes.

- Debt-to-equity ratio: Specifically compares long-term debt to shareholders’ equity.

- Gearing ratio: A broader measure using various formulas that consider different types of debt relative to capital structure.

Both ratios are essential for evaluating financial risk. The debt-to-equity ratio is useful for quick financial assessments, while the gearing ratio offers deeper insights for long-term planning.

When to use the debt-to-equity ratio vs the gearing ratio

When deciding which metric to use, consider your business's needs:

- Debt-to-equity ratio: Ideal for quick financial assessments and standardized comparisons. It’s useful when you need to get a snapshot of how much debt your business has relative to equity.

- Gearing ratio: Provides a deeper analysis, making it ideal for strategic planning and long-term financial management. It’s helpful when you want a more comprehensive view of your financial leverage across different types of debt.

How to calculate the gearing ratio

1. Calculate total debt: Include all financial liabilities, including loans, bonds, and credit lines.

2. Determine total equity: Add retained earnings and share capital to calculate the owner’s total investment in the business.

3. Apply a gearing ratio formula: Use one of these common formulas:

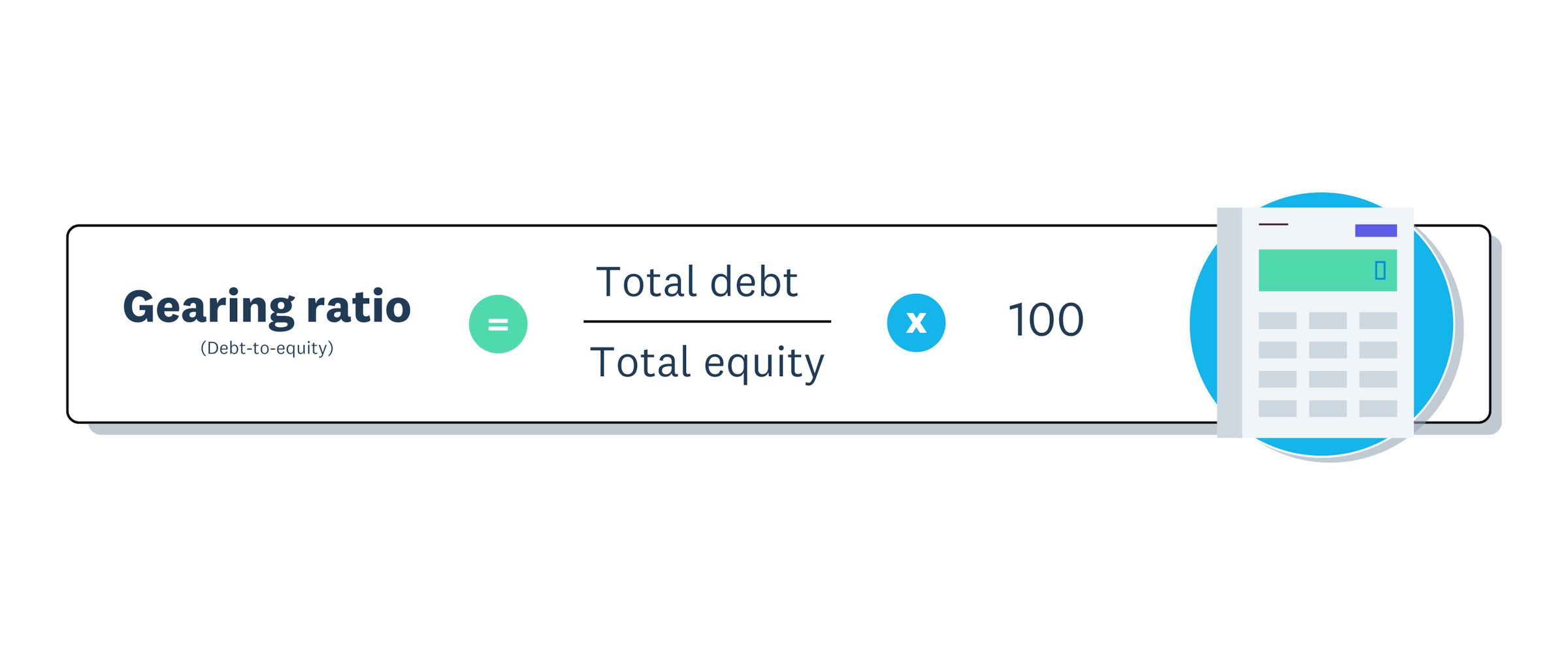

- Debt-to-equity formula: Gearing ratio = (Total Debt / Total Equity) × 100

- Debt-to-capital formula: Gearing ratio = (Total Debt / (Total Debt + Total Equity)) × 100

4. Interpret the Result:

- A higher percentage indicates a higher reliance on debt

- A lower percentage shows a stronger equity position.

Example gearing ratio calculations

Here are a couple of practical examples of how to calculate a gearing ratio:

- Total debt: $50,000

- Total equity: $100,000

Using the debt-to-equity formula:

Gearing ratio = (Total debt / Total equity) × 100

Gearing ratio = ($50,000 / $100,000) × 100 Gearing ratio = 50%

Using the debt-to-capital formula:

Gearing Ratio = (Total Debt / (Total Debt + Total Equity)) × 100

Gearing Ratio = ($50,000 / ($50,000 + $100,000)) × 100 Gearing Ratio = ($50,000 / $150,000) × 100 Gearing Ratio = 33.3%

Gearing ratio analysis

Interpreting the gearing ratio is vital for assessing a business's financial health. It provides insights into the balance between debt and equity and how that impacts a company's risk and stability.

- Moderate gearing (≈50%): Generally represents a balanced financial approach for most small and medium-sized businesses (SMBs).

- High Gearing (Above ≈70%): Indicates a heavier reliance on debt, and increased financial risk.

- Low Gearing (Below ≈30%): Suggests a strong equity position, offering lower risk exposure and greater stability.

Typical gearing ratios vary significantly by industry, growth stage, and risk tolerance. Many SMBs maintain a 30% to 50% debt mix, leveraging borrowed funds to support growth while relying on equity for stability. Striking the right balance is key to managing financial risk and sustainable growth.

High vs low gearing: what’s the difference?

The difference between high and low gearing comes down to the balance between debt and equity to fund your business.

- High gearing means relying more on debt than equity. A retail store taking out a large loan to buy inventory and renovate its premises would have a high gearing ratio – great for growth if sales thrive, risky if revenues drop or interest rates jump. High gearing can work if your business has a stable cash flow that can service debt, or if you're in a high-growth industry where revenues are increasing and you need to borrow to grow quickly.

- Low gearing means using more equity and less debt. A family-owned cafe expanding by using saved profits may grow more slowly than if they’d borrowed to do so, but they’d keep financial risk to a minimum. Low gearing is the ‘safety first’ choice. By relying on equity and minimizing debt, you’re prioritizing long-term security – perhaps because market conditions are unstable – and financial stability. Low debt protects your credit rating, too.

Finding the right balance is key to managing financial risk so your business is ready to seize growth opportunities.

Take control of your finances with Xero

Xero gives you the tools to keep your business financially stable and support its growth. Xero makes managing your business’s finances simple and efficient. Its automated calculations, clever features, and real-time financial reports help you track gearing ratios, streamline accounting tasks, stay compliant and report clear, up-to-date information to your stakeholders.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.