Powerful cloud payroll software for New Zealand

Easily pay your employees the correct amount every time, with the confidence you're Payday filing compliant. Xero payroll software automates tax and KiwiSaver calculations, saving you hours every month.

Fast, accurate payroll

Sail through your paydays with Xero. The payroll accounting software helps automate manual work to save you time and errors.

Automated online payroll

Let Xero’s payroll software calculate your staff’s pay, tax, and KiwiSaver for fully accurate figures.

Automated payday filing

Xero sends reports automatically to IR every pay run, so you know they’re filed on time, every time.

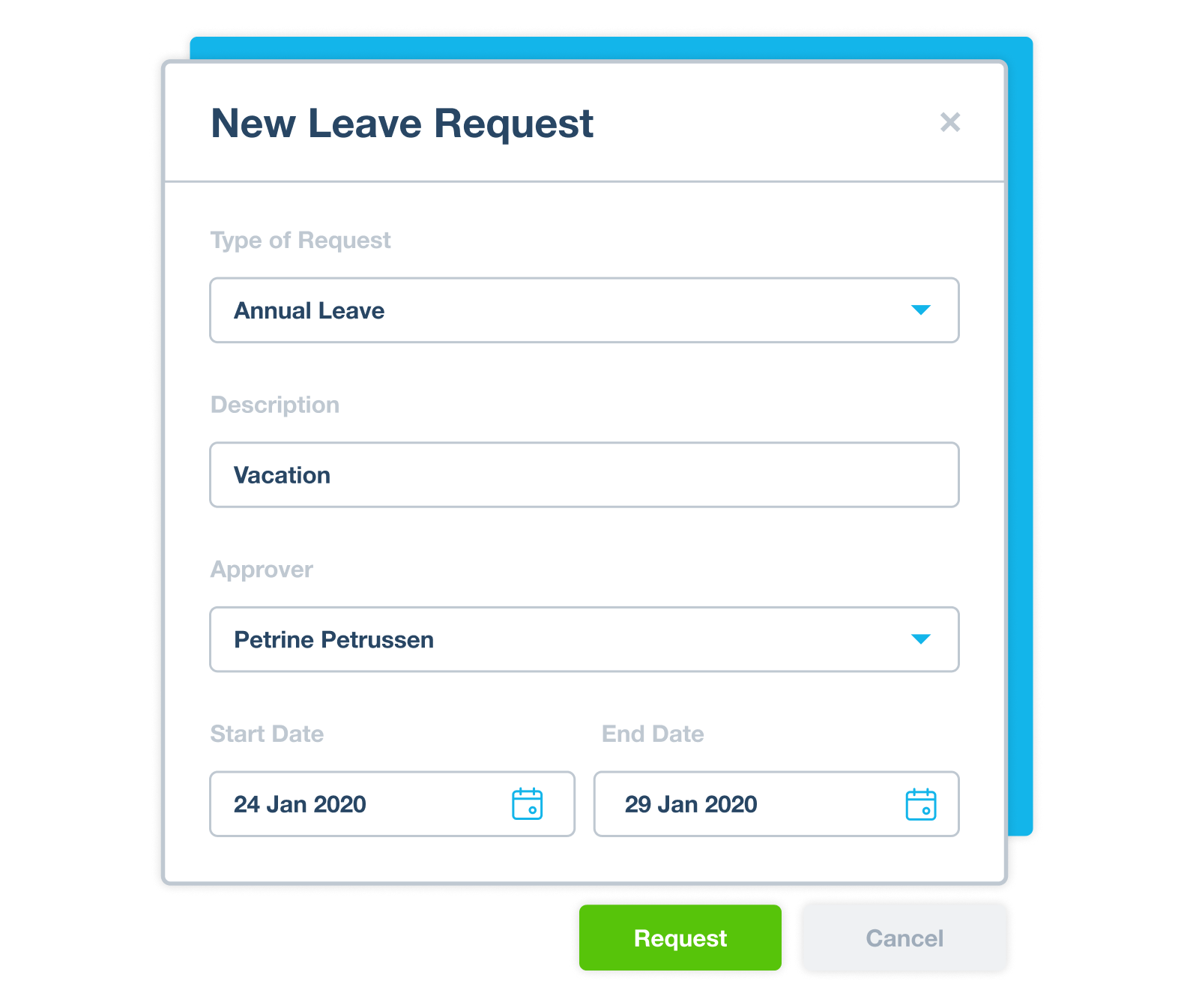

Employee self-service

Ask your team to use the Xero Me mobile app to access their payslips and request leave. Save yourself the admin!

Automated payday filing in New Zealand

Xero’s payroll software helps smooth your payroll processes and keep you compliant with changing Inland Revenue requirements, including payday filing. Sit back while Xero files your payday info with the right figures, right on time.

- Let Xero file your employee pay details with IR every pay run

- Connect to IR just once when setting up your payroll online

- See your payday filing history and easily update the information

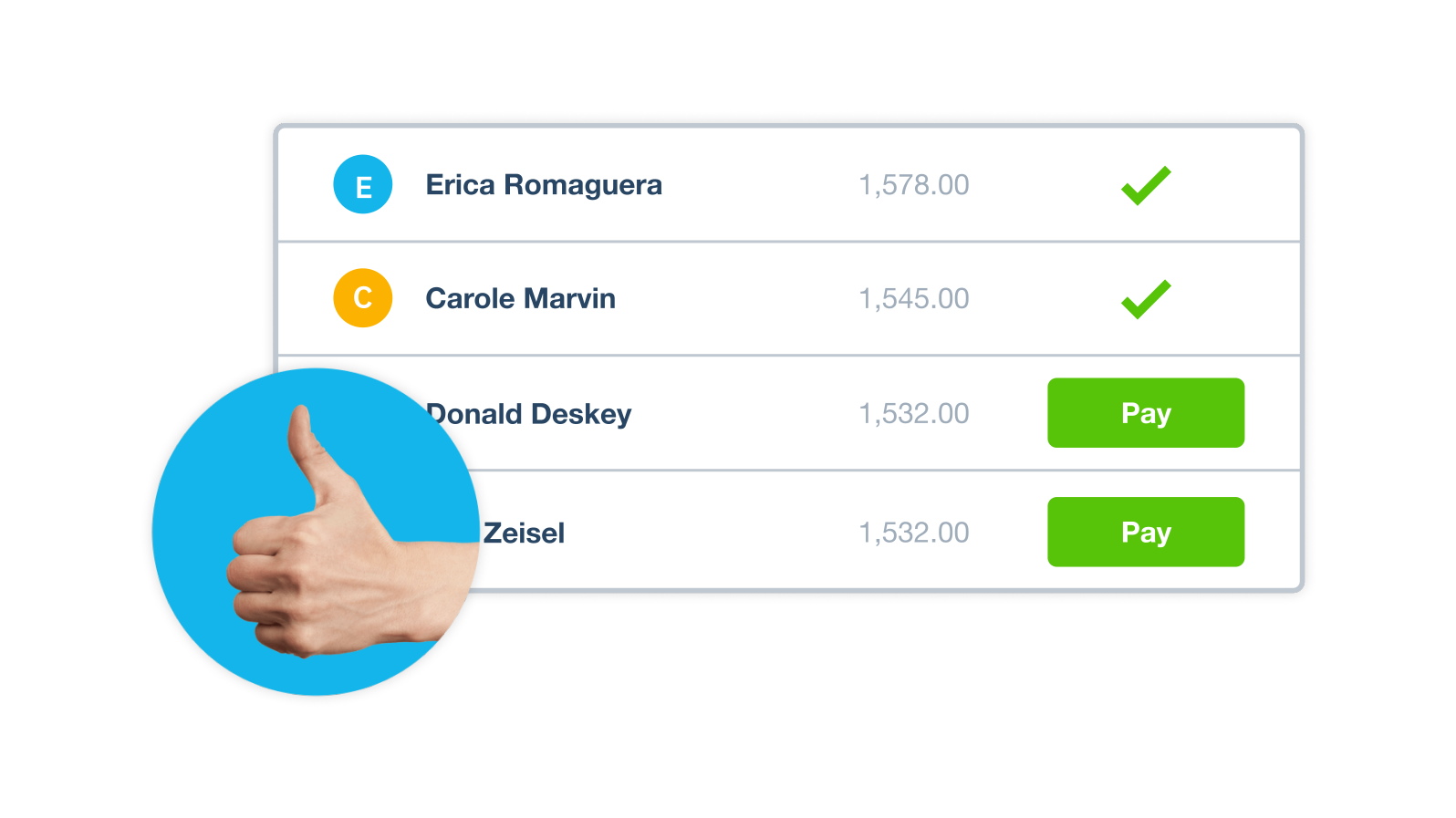

Automated New Zealand payroll calculations

Just picture it: a payday where payroll software does the work for you. The peace of mind from knowing tax calculations are accurate and your figures are up to date. Well, it’s here: pay yourself and your team in just a few clicks with Xero’s payroll software for small businesses.

- Automatic payroll calculations for employee pay, tax rates, and Kiwisaver contributions

- Flexible pay calendars and pay rates give you full control

- Direct deposits mean fast and secure payments – and happy employees

- Payslips are instantly available for employees in the Xero Me mobile app

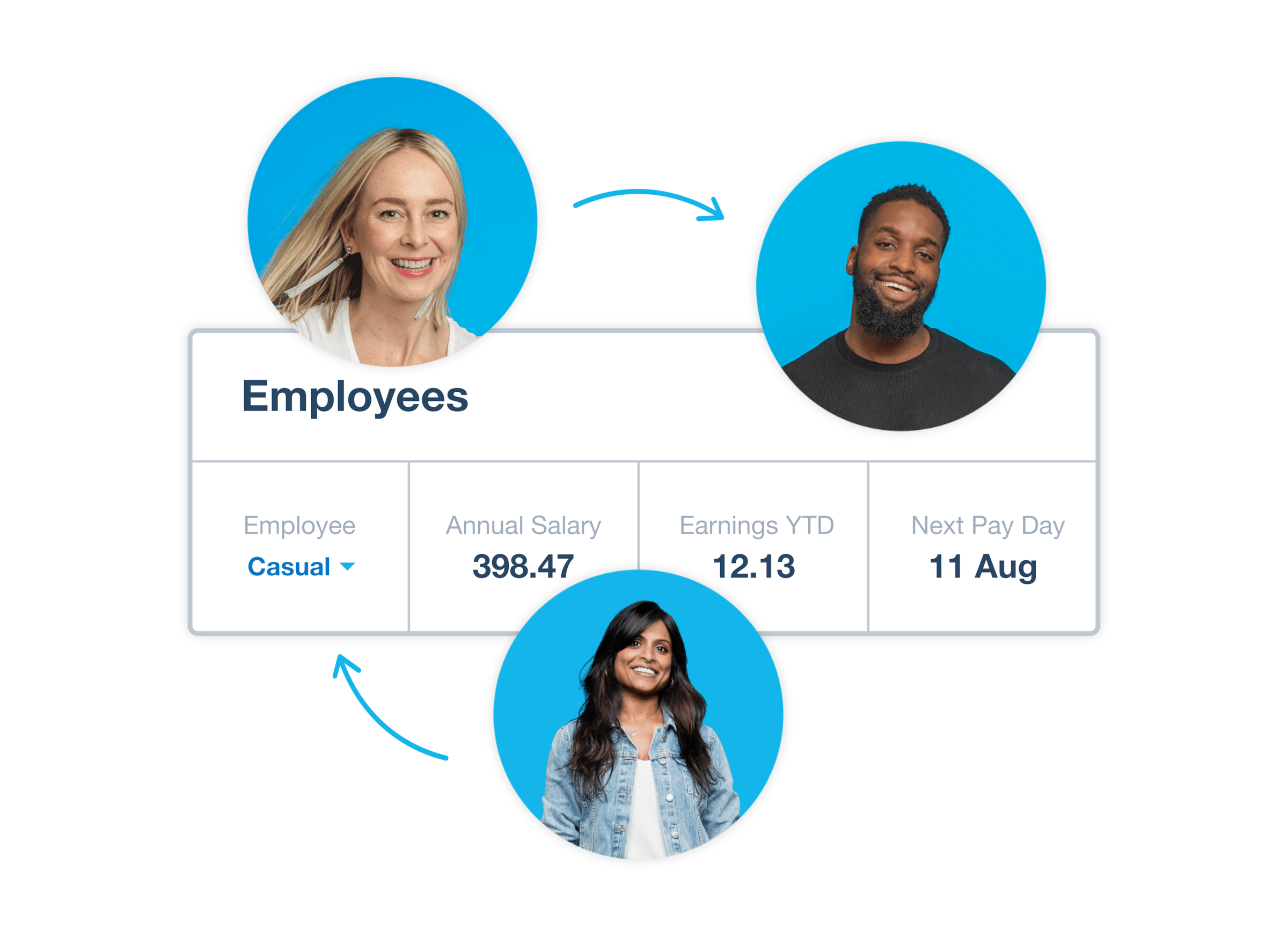

Save time with employee self-service

It’s a big time-saver for you when your team can work with their own pay records. With the easy-to-use Xero Me mobile app, they can see and update their own payroll information. And you’re in control: you choose which team members can review and approve leave requests and timesheets. Employees can:

- Access their own payslips

- See leave balances and submit leave requests

- Submit timesheets

- Do everything on the go

Stay compliant with Xero

Xero’s payroll software gives you full confidence with IR rules. Nail your pay calculations and comply with tax legislation. And keep your business’s financial records in one central place in the cloud, organised and ready for whenever you need a payslip or HR document.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

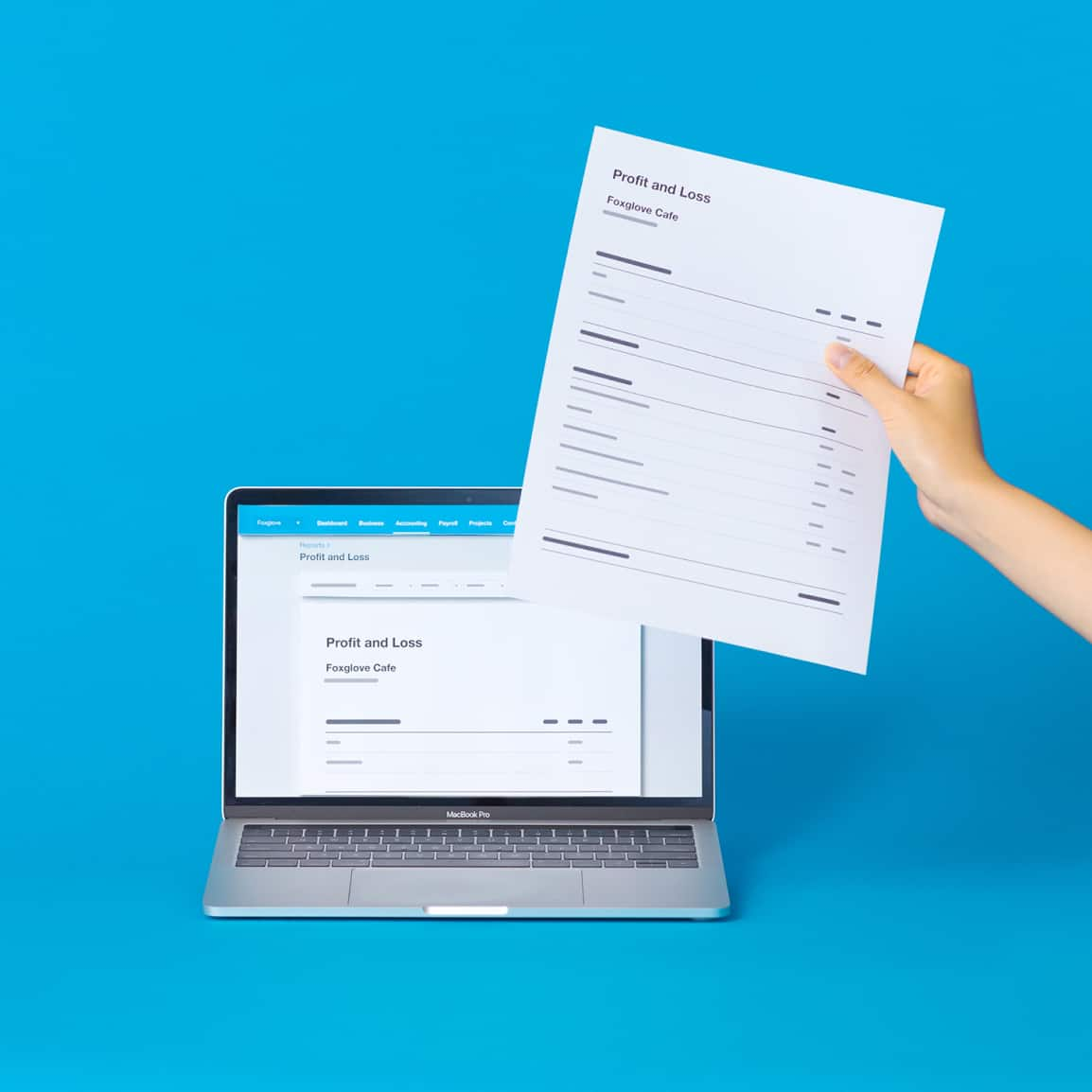

Take control of financial year-end with Xero

The year-end can sneak up on us. Integrate your accounting and payroll software in advance so your records are right and ready to go.

Simplify your entire business with Xero

Xero doesn’t just simplify your payroll – it eases all your financial admin, from invoicing and receiving payments to managing cash flow.

How Xero can empower your business

Discover how Xero’s clever features and design can transform the way you manage your business finances.

Xero versus Reckon

Looking for an alternative to Reckon? Xero accounting software can help you take control of your business.

Xero versus MYOB

When it comes to reliable, user-friendly accounting software, Xero’s MYOB alternative has everything you need.

Software for better business

Xero software boosts every aspect of how you organise and manage your financial admin.

I’ve gone from zero control to Xero control

Made by the Forge uses Xero to make quick decisions

FAQs about payroll in Xero

Yes, Xero automates payday filing of each pay run by seamlessly integrating with Inland Revenue.

Find out more about Xero payday filingRead about payday filing requirements from Inland RevenueYes, Xero automates payday filing of each pay run by seamlessly integrating with Inland Revenue.

Find out more about Xero payday filingRead about payday filing requirements from Inland RevenueThe Xero App Store offers hundreds of apps that can help you run your business, locally in New Zealand or all over the world.

Explore the Xero App Store to find apps to help run your businessThe Xero App Store offers hundreds of apps that can help you run your business, locally in New Zealand or all over the world.

Explore the Xero App Store to find apps to help run your businessXero payroll has a range of reports for your use and to help you file returns with Inland Revenue. You can also share payslips with employees directly from Xero.

See more information from Inland Revenue about being an employerXero payroll has a range of reports for your use and to help you file returns with Inland Revenue. You can also share payslips with employees directly from Xero.

See more information from Inland Revenue about being an employerXero’s support team is available 24/7, plus you can find a range of learning resources and support articles through the online payroll learning hub and Xero Central.

Visit Xero CentralXero’s support team is available 24/7, plus you can find a range of learning resources and support articles through the online payroll learning hub and Xero Central.

Visit Xero Central

Payroll resources for small businesses

Benefits of payroll accounting software

Find out about the benefits of an efficient payroll system for your business and your employees.

Tips for choosing online payroll software

Learn about government requirements and what to look for when you’re choosing payroll software.

Getting your head around business payroll

If you’re starting to employ people, here’s an intro to the basics of pay, deductions, and dealing with IR.

See how online payroll streamlines tasks

Stop dreading this.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

FAQs about Xero in New Zealand

Yes, you can connect your Xero account with the IRD (Inland Revenue Department) to more easily prepare and submit your returns, so you never miss a deadline.

Find out more from the IRD on running a business.Yes, you can connect your Xero account with the IRD (Inland Revenue Department) to more easily prepare and submit your returns, so you never miss a deadline.

Find out more from the IRD on running a business.Yes, Xero complies fully with payday filing. Your payroll administrator only needs to connect to the IRD once, and then employee pay details are filed with the IRD each pay run.

Yes, Xero complies fully with payday filing. Your payroll administrator only needs to connect to the IRD once, and then employee pay details are filed with the IRD each pay run.

The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.The best accounting software depends on your needs. Xero’s accounting software has flexible plans so you can adjust your subscriptions to access the features you need as your business grows.

Check out Xero’s pricing plans.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.No – Xero is based in the cloud, so all you need is an internet connection. But you need a multi-factor authentication (MFA) app to log in to Xero. MFA extra layer of security by checking that it’s really you when you log in.

Learn about data protection with Xero.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in New Zealand.

Check out the Xero App Store.Yes, the Xero App Store has hundreds of apps to help manage your business, including apps specifically designed for your industry and for doing business in New Zealand.

Check out the Xero App Store.

Already subscribed and need help with Xero payroll?

Xero Central is filled with articles to help you pay your team.

Set up an employee's leave entitlements

Staff off on holiday? Get your employee’s wages right.

Add or edit an employee timesheet

Submit employee timesheets for the current pay period and approve them before you process the pay run.

Learn about payroll for your employees

Find articles and discussion on setting up your payroll, including paying taxes.