Xero Tax for accounts and tax compliance

Take control of accounts and tax returns for companies and individuals all in one place, in the cloud, with Xero Tax.

Watch our step by step video

Benefits of Xero Tax

Streamlined workflow

Data flows between your clients’ bookkeeping, accounts and tax returns, helping streamline your workflow.

Corporation Tax and Company Accounts

Prepare and file CT600 returns and XBRL tagged company accounts to HMRC and Companies House as relevant.

Personal Tax and Sole Trader Accounts

Prepare and file personal tax returns (SA100) and produce unincorporated accounts for sole traders.

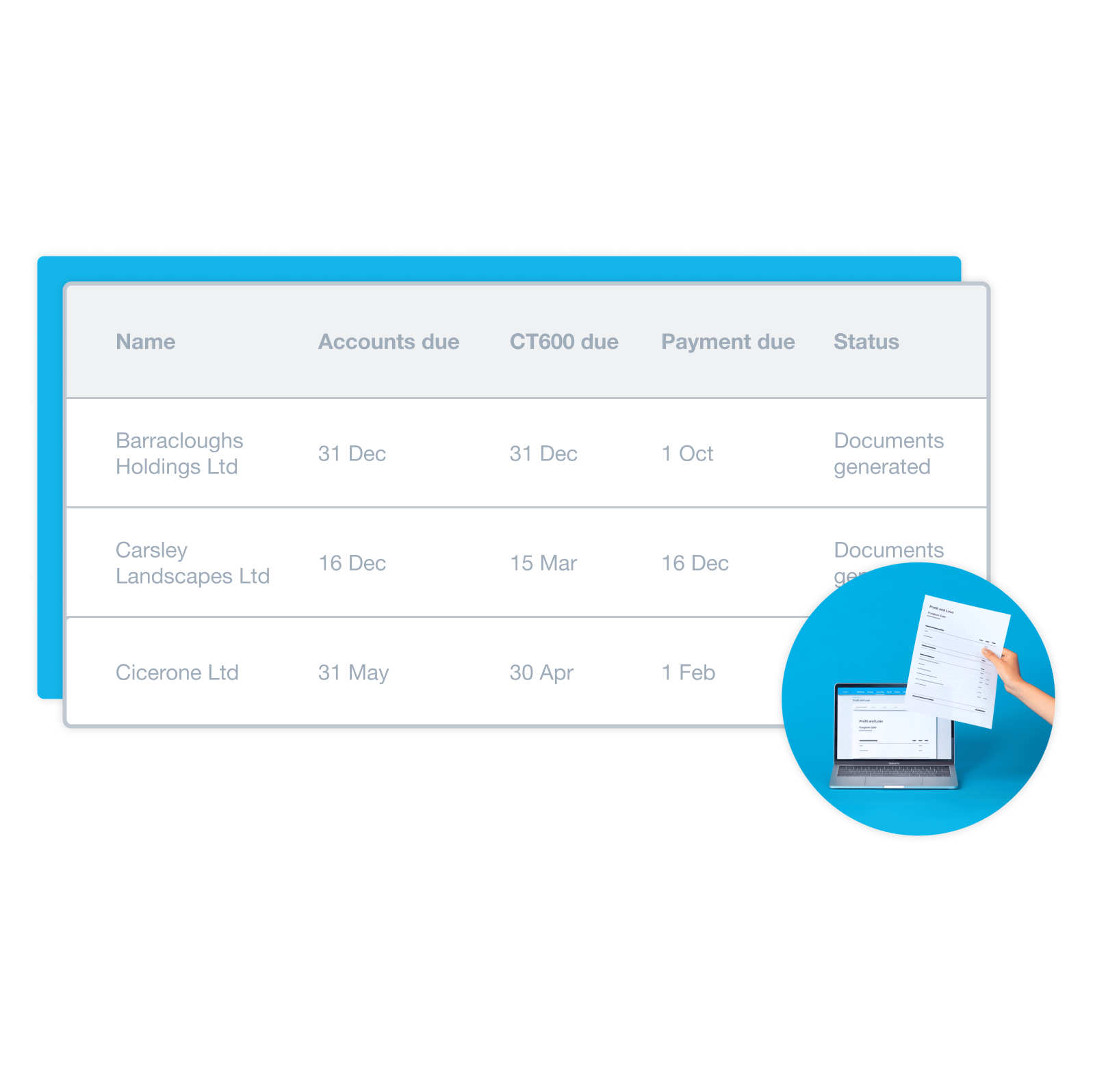

Manage tax returns

Xero Tax streamlines compliance by making it much faster to prepare and file accurate accounts and tax.

- Connect to bookkeeping data from Xero

- Produce and file accounts

- Prepare and file company and personal tax returns (SA100 tax return forms, with supplementary pages, some in development, as well as SA302)

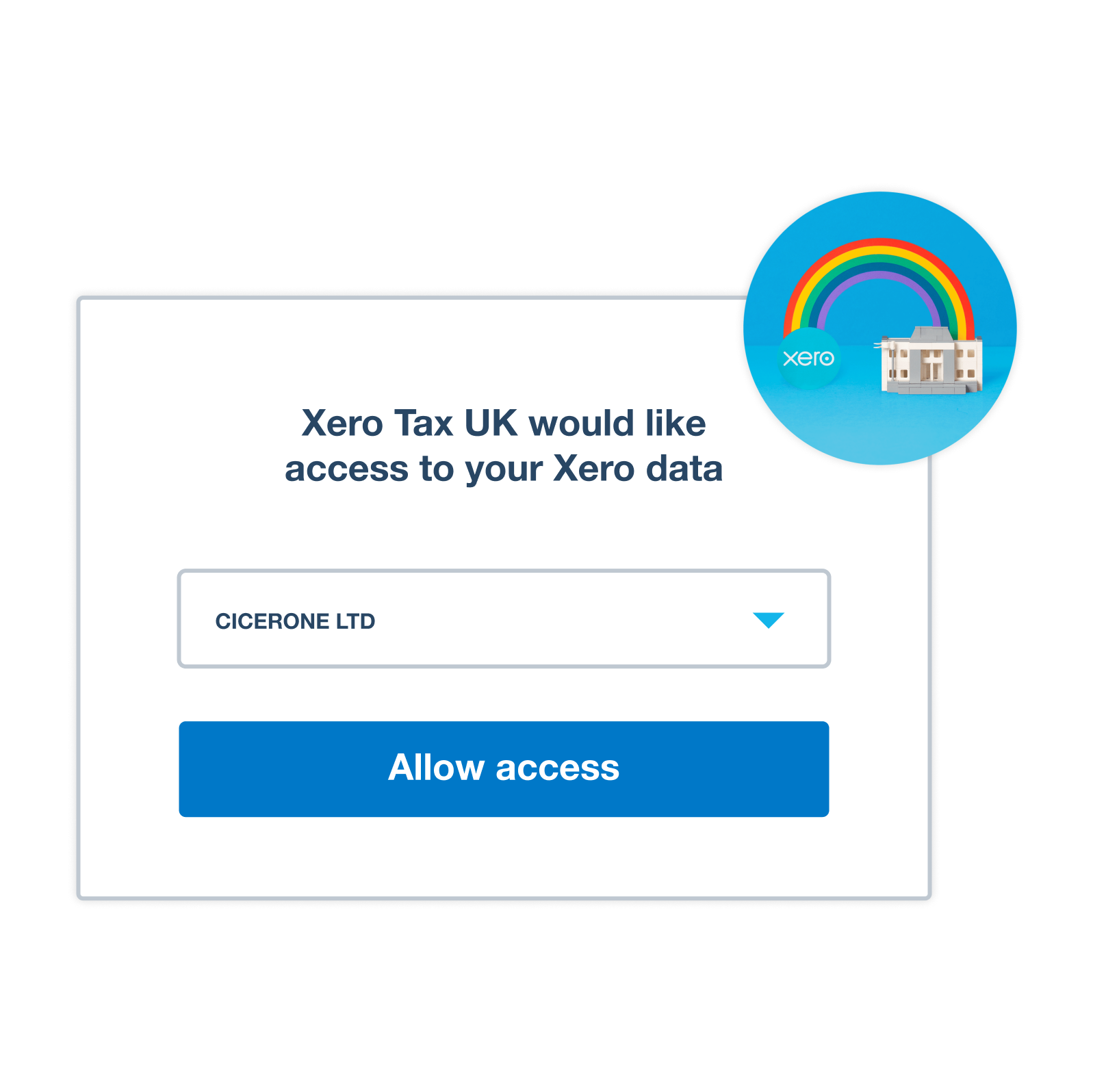

Share data across Xero

Data flows easily between Xero and Xero Tax which keep data entry to a minimum.

- Data is protected by multiple layers of security

- Client details and accounts data flow from Xero into Xero Tax

- Import trial balance amounts from Xero accounts into tax returns

Produce accounts easily

Streamline accounts production for sole traders as well as companies.

- Populate company accounts and tax returns from Xero’s core data

- Retrieve data from Companies House to populate company accounts

- Produce accounts for sole traders, with income schedules populated from Xero

Submit returns online

File annual accounts and tax returns for company and individual clients directly from Xero Tax.

- Submit corporate tax returns for company clients to HMRC

- Submit personal tax returns for individual clients to HMRC

- File company accounts with Companies House direct from Xero

How Xero Tax helps DSK Partners save time

Hear how Paras Shah, Workflow Manager at DSK Partners, has achieved time savings of 25% since adopting Xero Tax.

Watch the case study

More about Xero Tax

No special connection is needed. Just enable Xero Tax in Xero HQ and give staff access. Xero Tax uses your existing Xero login details.

See how to set up Xero TaxNo special connection is needed. Just enable Xero Tax in Xero HQ and give staff access. Xero Tax uses your existing Xero login details.

See how to set up Xero TaxXero Tax automatically tags any chart of accounts with the appropriate iXBRL (Inline eXtensible Business Reporting Language) tags. It uses the iXBRL tagging to format company accounts for corporate tax returns.

See how to generate company accounts and tax returnsXero Tax automatically tags any chart of accounts with the appropriate iXBRL (Inline eXtensible Business Reporting Language) tags. It uses the iXBRL tagging to format company accounts for corporate tax returns.

See how to generate company accounts and tax returnsTo help you get going, we’ve created a handy all-in-one downloadable guide containing best practices.

Download the guideTo help you get going, we’ve created a handy all-in-one downloadable guide containing best practices.

Download the guideXero Tax checks transactions in Xero for common problems. Just click through from Xero Tax to see the transactions that make up an amount in the accounts or tax return. If you make corrections in Xero, regenerate the annual accounts and tax return.

See how to edit generated accounts and reportsXero Tax checks transactions in Xero for common problems. Just click through from Xero Tax to see the transactions that make up an amount in the accounts or tax return. If you make corrections in Xero, regenerate the annual accounts and tax return.

See how to edit generated accounts and reportsCollate reports and tax returns to share securely with clients for digital signatures, from within Xero Tax. Clients can access and e-sign documents in the Xero portal, which seamlessly updates the documents’ status in real time.

See how document packs worksCollate reports and tax returns to share securely with clients for digital signatures, from within Xero Tax. Clients can access and e-sign documents in the Xero portal, which seamlessly updates the documents’ status in real time.

See how document packs works

Start using Xero Tax for free

Xero Tax, part of Xero HQ, is free for accountants and bookkeepers as part of the Xero partner programme.