Federal withholding tax tables 2025 and Xero’s tax calculator

Use 2025 federal tax tables and Xero’s free calculator to withhold the right amount from employee paychecks.

Key takeaways

- The IRS adjusted income thresholds for tax brackets in 2025, but the tax rates remain the same as 2024.

- Standard deductions for 2025 have increased: $15,000 for single filers, $30,000 for married filing jointly, and $22,500 for heads of household.

- The Earned Income Tax Credit (EITC) for taxpayers with three or more children has increased to $8,046 in 2025.

- The right federal withholding tax table depends on your payroll system and the year of your W-4 form.

- Several factors affect federal tax withholding, including your filing status, total income, W-4 adjustments, and pay frequency.

- Xero’s payroll withholding calculator helps ensure accurate withholding by calculating taxes based on employee details and allows for previewing W-4 updates.

Table of contents

Federal withholding tax tables and updates for 2025

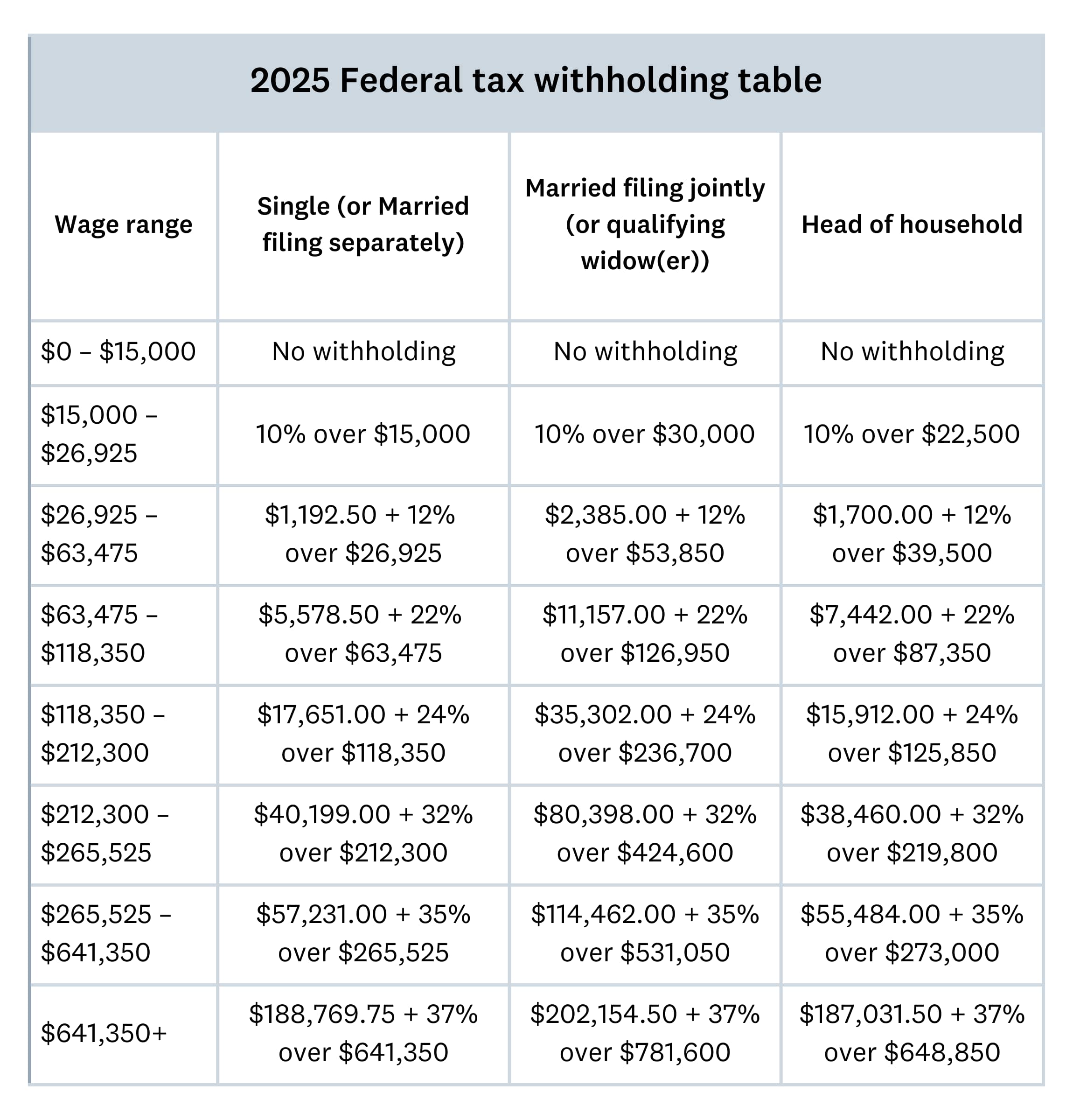

For 2025, the IRS has adjusted the income threshold for each tax bracket to account for inflation, while the tax rates remain unchanged from the 2024 federal withholding rates. The seven tax brackets remain at 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The standard deduction has also increased for 2025:

- Single filers: $15,000 (up from $14,600 in 2024)

- Married filing jointly: $30,000 (up from $29,200 in 2024)

- Heads of household: $22,500 (up from $21,900 in 2024)

The EITC (Earned Income Tax Credit) for taxpayers with three or more children also increased to $8046 for 2025, up from $7830 last year.

The federal withholding tax table 2025 below outlines the adjusted income thresholds and tax rates by filing status.

Which federal withholding tax table should you use?

The right federal withholding tax table for you depends on your payroll system and the year of your W-4 form. If you have:

- An automated payroll system: use the percentage method tables

- A manual payroll: use the wage bracket method tables

- A W-4 from 2020 or later: use the new withholding tables, which do not account for allowances

Refer to the current IRS Publication 15-T, which includes the IRS withholding tax table used to determine the right federal tax withholding amounts. The IRS republishes it annually with the latest updated tax withholding tables.

Learn more about payroll withholding taxes.

How to withhold the right amount of federal tax

Know how to calculate withholding tax so you can process your payroll accurately. It’s not as simple as following a single formula – the withholding amount depends on things like your:

- Filing status: single, married, or head of household

- Total income: includes multiple jobs, income from a spouse if married, or additional earnings from other side gigs or investments

- W-4 adjustments: dependents, deductions, and extra withholding

- Pay frequency: weekly, bi-weekly, or monthly pay schedules

Understanding employer tax deductions will help your business manage payroll costs while staying compliant with IRS regulations.

How to use Xero’s tax withholding calculator

To calculate withholding for an employee

Enter your employee’s gross pay, filing status, and W-4 details into Xero’s payroll withholding calculator. The tool then determines the correct federal tax to withhold based on your employee’s income, deductions, and pay frequency.

To estimate the total withholding tax for your entire payroll

Enter your total gross payroll and employee information for a pay period. The calculator then generates an overview of total federal tax withholding across all employees.

To adjust withholding amounts

When an employee updates their W-4 data, Xero’s calculator lets you preview changes to the withholding amount to make sure you’re complying with federal tax rules.

To do this, just enter your team member’s new filing status, deductions, or extra withholding into the calculator. This lets you preview changes to the withholding amount and ensure compliance with federal tax regulations.

FAQs on federal withholding tax

1. What is federal withholding tax?

Federal withholding tax is money you deduct from your employees’ paychecks based upon information provided by the employee on their W-4 form to cover federal income taxes expected to be owed to the IRS. This system makes it easier for you to meet your tax obligations by making deductions throughout the year as the employee earns their wages. Federal income taxes are expected to be paid as income is earned.

2. How do I use the federal withholding tax table?

First, determine your employee’s filing status (single, married, or head of household). Then, select the correct table based on their W-4 form. Next, find their wage range for the pay frequency (weekly, biweekly, or monthly). And finally, follow the row across to find the right tax rate, which you use to calculate the withholding amount.

3. How do I calculate federal withholding tax?

You work out your team’s federal withholding tax based on each employee’s income, filing status, and pay frequency. All of these factors are considered when employees complete their W-4 form. Use the IRS withholding tax tables or an employee tax withholding chart to calculate the right amount to deduct from each paycheck.

4. What is Form W-4, and why is it important?

Your employees use Form W-4 to tell you how much federal income tax to withhold from their paychecks. So encourage your team to fill it out accurately and update it whenever their financial situation changes, so they won't owe unexpected taxes or get a surprising refund at tax time.

5. Are federal withholding taxes the same as FICA taxes?

No. Both are deducted from your employee’s paycheck, but serve different purposes:

- Federal withholding tax is to pay the employee’s income tax – the amount withheld depends on income levels, filing status, other income, and is detailed in completed W-4 forms completed by employees.

- Federal Contributions Insurance Act (FICA) taxes fund Social Security and Medicare at fixed percentages. FICA taxes are paid by employers and employees.

6. Can employees change their withholding amount?

Yes. Major life events like marriage, children, or a second job will affect their withholding. When an employee has any of these life changes and wants to change their withholdings, ask them to fill out a new Form W-4 and submit to you so their paycheck withholdings are updated as needed. You can change your withholding amount anytime – you don't need to wait for tax season.

7. What happens if I under-withhold federal taxes?

If the employee doesn’t withhold enough tax,they’ll owe the difference when you filing their individual tax return – and there could be IRS penalties and interest for underpayment. To prevent this, encourage your employees to review their withholdings with our calculator, especially after major life changes or if they have extra sources of income. If the employee does owe a large amount of taxes when filing their individual tax return, encourage them to review their W-4 form and update to avoid the underwithholding in the future.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This calculator has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.