Calculating Florida sales tax

Simplify the process with this Florida sales tax guide for a better idea of what tax to collect.

Published on Monday 14th April 2025

Table of contents:

How much is sales tax in Florida?

The Florida sales tax rate is 6% statewide for the sale of most taxable goods and services, but certain types of special purchases may have a different rate. For example, retail sales of new mobile homes are subject to a 3% sales tax rate instead of the statewide 6%. See the Florida Department of Revenue website for a list of special purchases and sales tax rates.

In addition to the statewide tax rate, local counties can add their own discretionary surtax. Discretionary sales surtax ranges from 0.5% to 2%, but there are some counties that do not impose any additional tax. This means the total sales tax can range from 6% - 8%, depending on where you do business.

Discretionary sales surtax only applies to the first $5000 of the sales amount of a single item of tangible personal property. This limit does not apply to non-tangible goods such as real estate rentals or services.

Let’s say you sold a $7000 refrigerator in a Florida county with a 1% discretionary surtax rate. The tax you would charge is as follows:

- 1% surtax to the first $5000 of the purchase price. 1% x $5000 = $50 surtax

- 6% statewide sales tax to the total purchase price of $7000. 6% x $7000 = $420 state tax

The total tax collected is $470, which is the sum of the discretionary surtax ($50) and the statewide tax ($420).

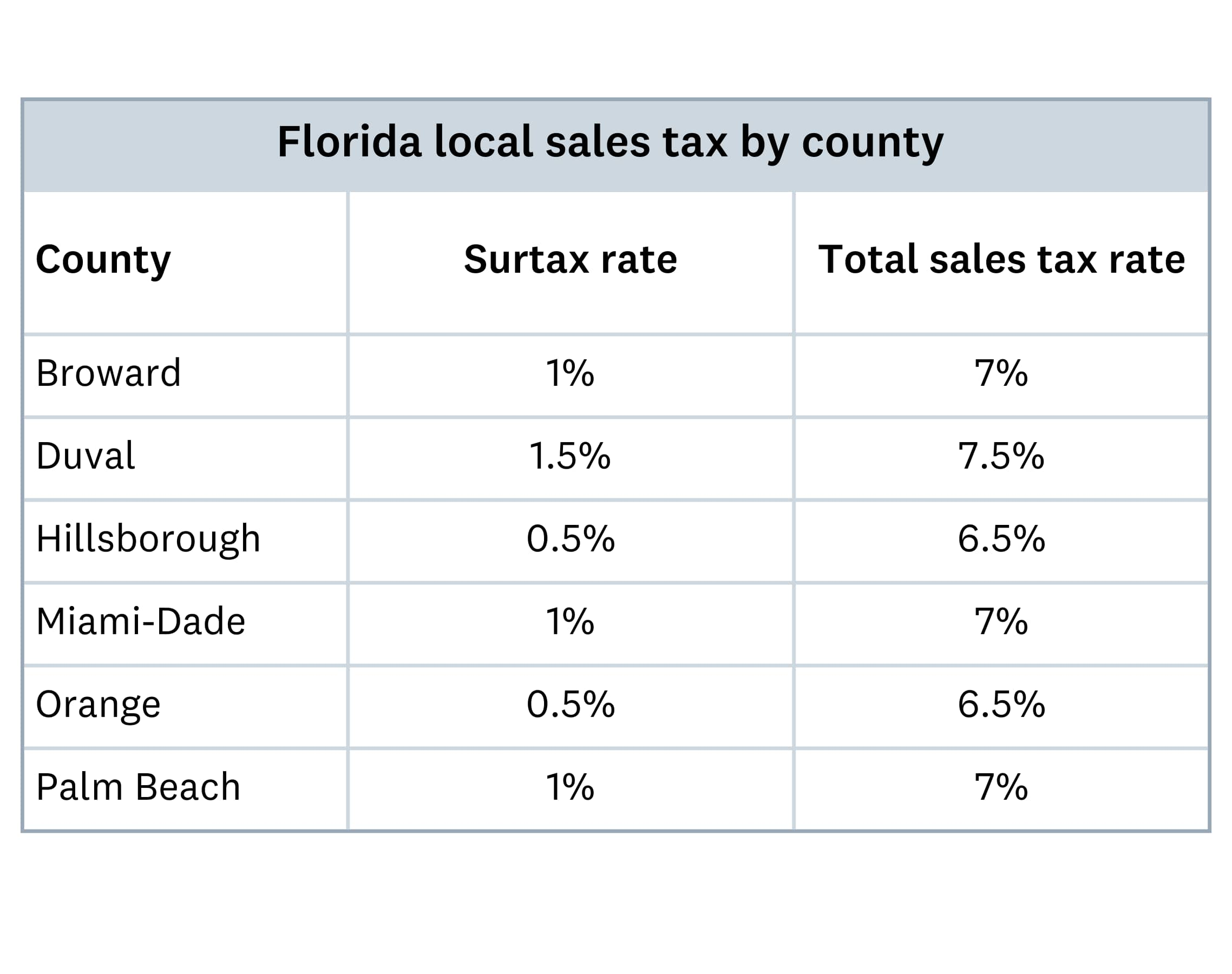

Florida local sales tax by county

The base sales tax rate in Florida is 6%, but each county can impose a discretionary surtax. Here are local rates for some of the most populated counties in Florida:

Discretionary surtax rates are updated annually. Staying updated on these rates is important, especially if you’re operating in multiple counties. Different tax rates can impact pricing, expenses, and compliance requirements, so check the Florida Department of Revenue website for the latest rates.

How to calculate Florida sales tax

Once you know the sales tax rate to charge, calculating the tax is simple.

- Use the formula of purchase price x (state tax + county surtax) = sales tax total.

- Add sales tax total to the price of the item for the total cost to the customer.

For example, you sell a $100 handbag in Miami-Dade. The total sales tax charged is 7% – this includes the 6% Florida state tax rate plus the 1% Miami-Dade discretionary surtax.

The tax calculation would be:

$100 (item price) x 0.07 (tax rate) = $7 (sales tax total). Add this to the item price, and the final amount the customer pays is $107.

Since counties set different surtax rates, the final amount differs by location. Check your local rates to ensure you apply the correct tax, or use an online tool like Avalara’s sales tax calculator.

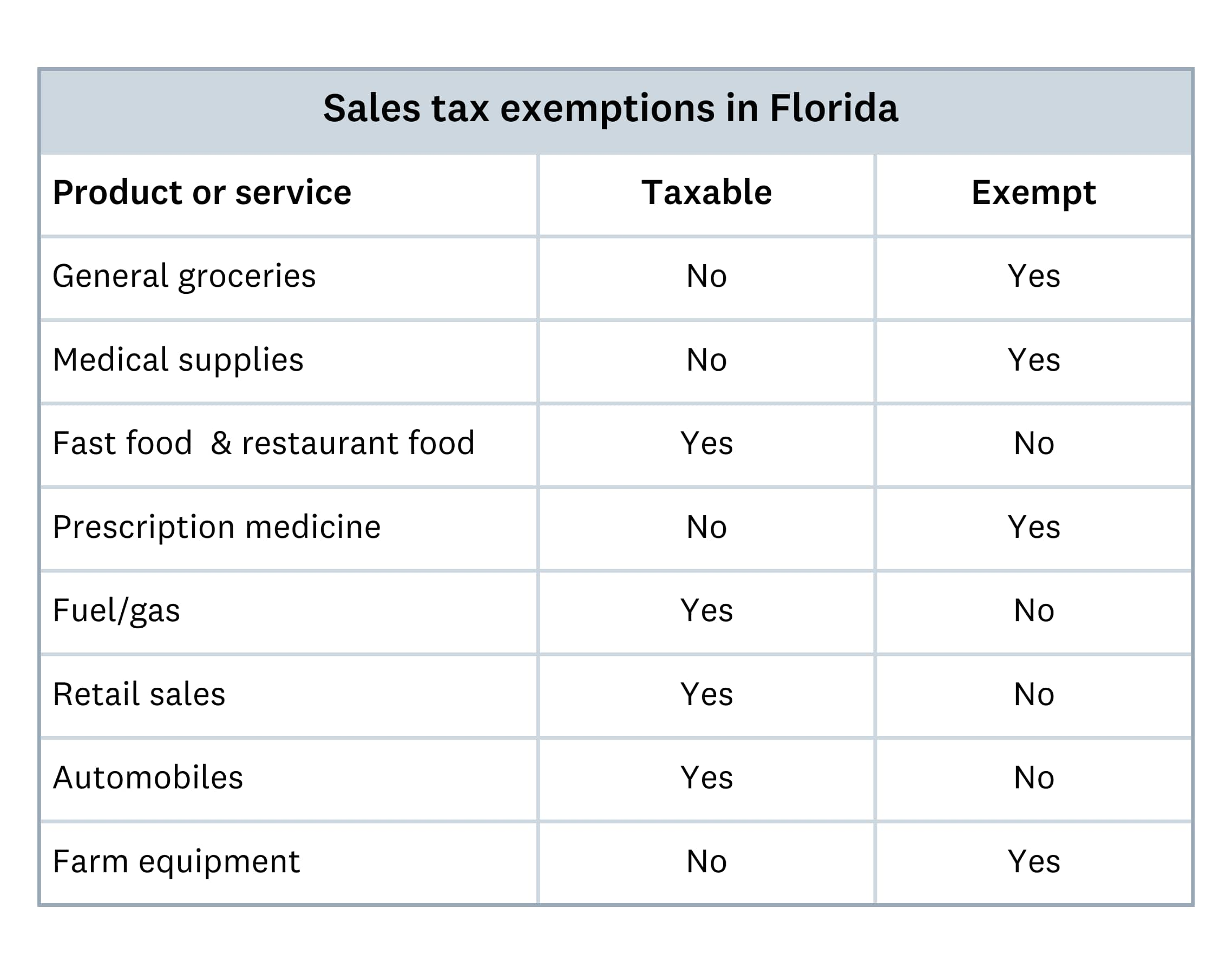

Sales tax exemptions in Florida

Most products and services are subject to Florida sales tax, with exemptions for certain items like prescription medications, unprepared foods, and government transactions. Here are some examples of Florida tax exemptions:

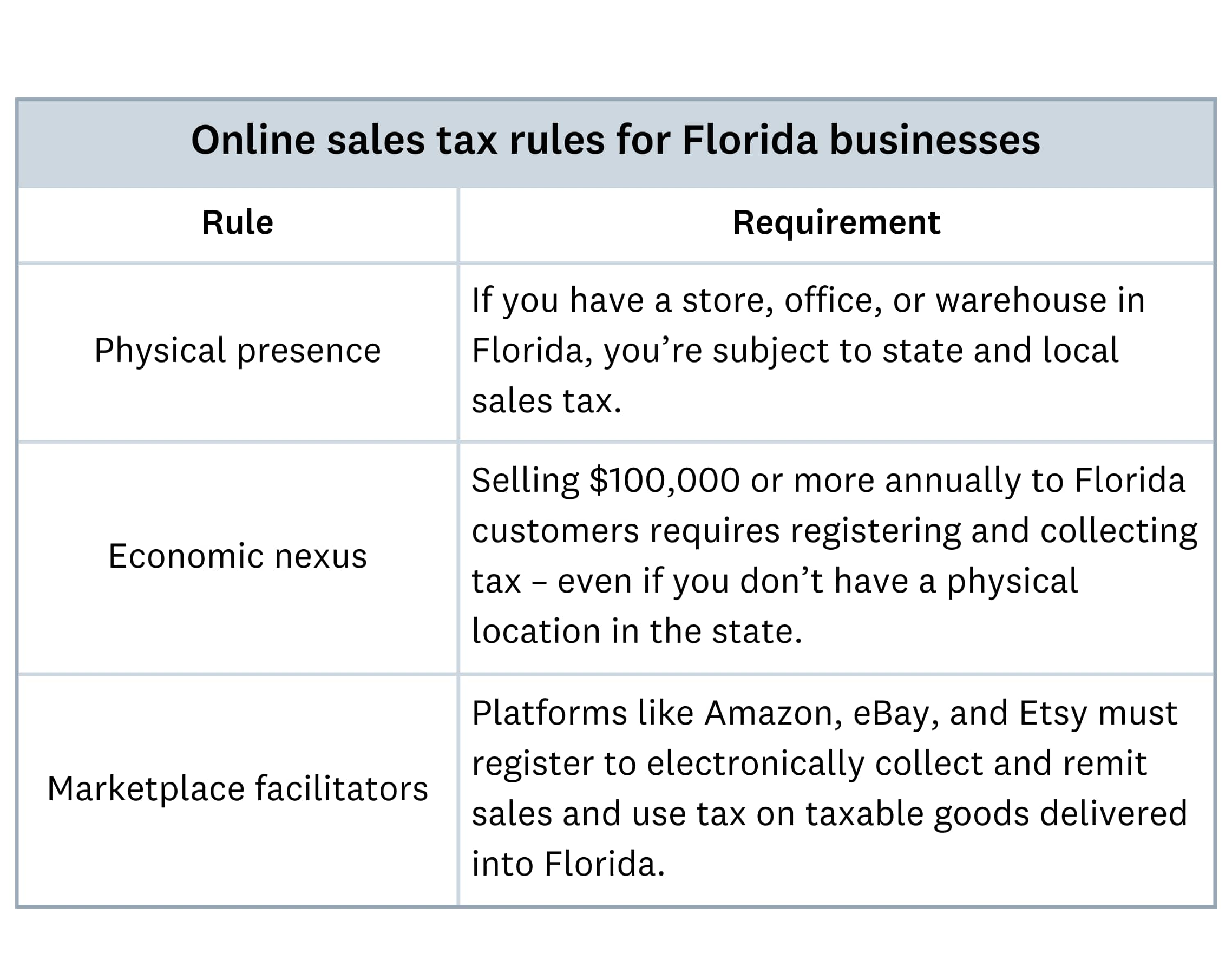

Online sales tax rules for Florida businesses

If you sell goods or services online, you need to follow Florida’s Internet Sales Tax Law (SB 50). Effective July 1, 2021, this law requires remote sellers and online marketplaces to collect the 6% state sales tax plus any applicable discretionary surtax if they meet certain thresholds. These thresholds include:

If your business sells online to Florida residents, you must ensure compliance when collecting and paying sales tax. Follow these steps to stay compliant:

- Register for a sales tax permit through the Florida Department of Revenue.

- Collect the correct tax rate (state sales tax plus applicable county surtax).

- File and remit taxes regularly based on your assigned filing frequency, such as monthly or quarterly.

- Keep records of transactions so you’re prepared for audits.

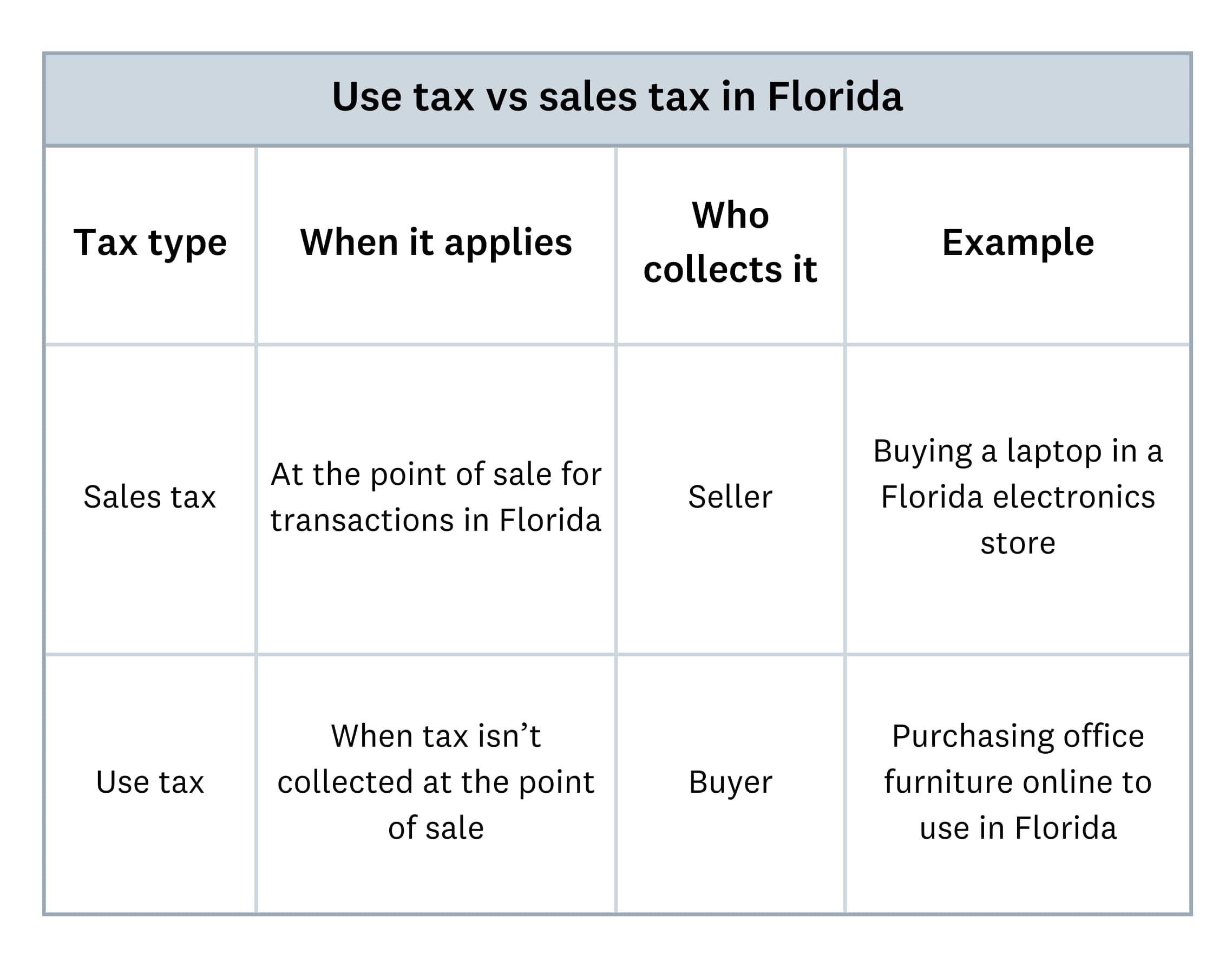

Use tax vs. sales tax in Florida

Florida doesn’t just have a sales tax. You could be required to pay use tax, depending on the situation. Here’s the difference:

- Sales tax: Seller charges at checkout when a customer buys something in Florida

- Use tax: Buyer pays directly when a seller doesn’t collect taxes at the time of purchase

Use tax applies when you don’t charge sales tax at the point of sale. Common examples of this would be:

- buying furniture online from a seller that doesn’t collect Florida sales tax

- purchasing goods tax-free while traveling out of state and bringing them back for use in Florida

- ordering wholesale products for personal use instead of resale

If you owe use tax, you have to report and pay it to the Florida Department of Revenue. This compliance helps prevent businesses from buying out-of-state to avoid business sales tax in Florida.

Understanding the difference will help you stay compliant and avoid penalties, so stay updated on your tax obligations when buying from out-of-state or online retailers.

FAQs about Florida sales tax

Do businesses in Florida need a sales tax permit?

Yes, any business that plans to sell taxable goods or services in Florida must register for a sales tax permit with the Florida Department of Revenue before starting operations. However, government entities, schools, and some qualifying nonprofit organizations are exempt from paying sales and use tax and don’t require a permit.

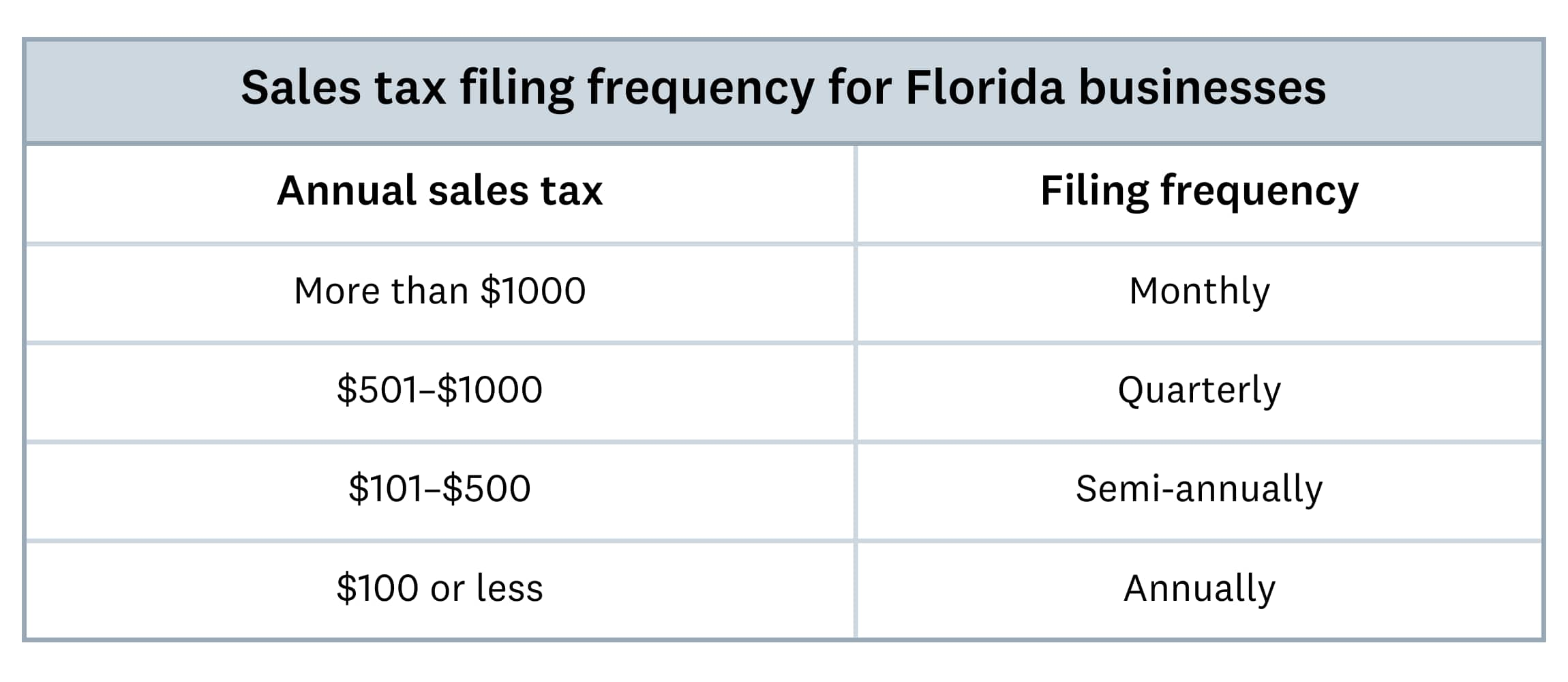

How often do Florida businesses need to file sales tax returns?

Most businesses file and pay sales taxes quarterly, but your business may qualify for a different filing frequency depending on how much tax you collect. The Florida Department of Revenue outlines specific thresholds for each filing period, which you can see below:

What happens if a business doesn’t collect or remit sales tax?

Failure to collect or pay sales tax can result in penalties, interest, and legal action. The Florida Department of Revenue may conduct audits and assess fines, including a penalty of 10% of the unpaid tax per month, up to 50% of the total owed.

Is labor subject to sales tax in Florida?

It depends on the type of labor. Services that relate to repairing, maintaining or improving tangible personal property are generally taxable, like repairs on a car or pest control services for a home. Labor that results in the creation of a new product is also taxable, such as jewelry design or custom furniture making. However, services like legal advice and healthcare are exempt from sales tax.

How does Florida’s sales tax apply to shipping and delivery charges?

If shipping charges are separately stated from the item’s price, they are generally not taxable. However, if shipping is bundled into the total price, it is considered taxable.

Do nonprofit organizations have to pay sales tax in Florida?

Certain nonprofits and financial institutions may be exempt from sales tax in Florida, including credit unions, 501(c) charitable organizations, and tax-supported schools, colleges, and universities. If eligible, nonprofit organizations must apply for a sales tax exemption certificate (Form DR-14) from the Florida Department of Revenue.

Are real estate transactions subject to sales tax in Florida?

No, real estate sales aren’t subject to sales tax, but commercial property rentals must pay sales tax plus any required county surtaxes. Buyers may also need to pay capital gains tax, tax on deed transfers, and any outstanding property taxes.

Does Florida charge sales tax on vehicle purchases?

Yes. If you purchase a vehicle, boat, or motorhome in Florida, it’s subject to the 6% state sales tax plus any local surtax on the first $5000 of the purchase price. If you buy from a private seller, you must self-report and pay sales tax when registering the vehicle.

Are digital goods and software subject to sales tax?

Florida does not tax most digitally delivered goods, such as eBooks or online streaming services. However, prepackaged software downloaded or sold on physical media is taxable.

Does Florida offer sales tax holidays?

Yes, Florida has multiple sales tax holidays throughout the year, such as the Back-to-School Tax Holiday, Disaster Preparedness Sales Tax Holiday, and the Freedom Week Sales Tax Holiday, during which select items are temporarily exempt from sales tax. For details on when these sales tax holidays are, see the Florida Department of Revenue website.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.