What are liquidity ratios?

Liquidity ratios assess a business’s ability to cover expenses, and utilize cash. Learn about the three ratios.

March 2024 | Published by Xero

What is liquidity?

Liquidity refers to how much cash (or anything you can quickly convert to cash) your business has on hand, and whether it's enough to pay your bills.

Cash flow issues are one of the biggest reasons new businesses shut their doors, but it isn't always easy to tell if you have enough cash on hand. Liquidity ratios help you gauge your short-term (12 months or less) financial health.

Once you understand your liquidity – and what a good liquidity ratio is – you can make smart decisions about business operations, expenses and investments. If you don't understand your liquidity, you may spend too much, grow too fast, or perhaps even worse, underuse your resources.

What are liquidity ratios?

Liquidity ratios are measures of the gap between your cash and your bills. There are three widely used liquidity ratios in accounting:

When using accounting software like Xero, you can click to see your quick ratio at any time. Here’s that those liquidity ratios mean.

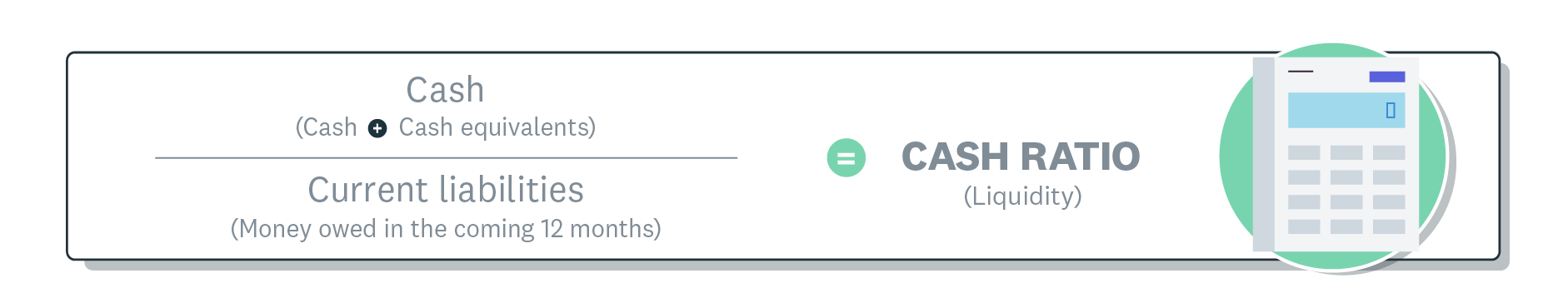

1. Cash ratio

The cash ratio is your cash and cash equivalents divided by your short-term liabilities. This ratio lets you know whether or not you can cover your payroll, expenses, and loan payments over the next year with the cash you have.

This liquidity ratio includes the fewest assets and is the fastest to calculate.

Cash ratio calculation

Cash ratio liquidity formula

The cash ratio calculation only includes the cash in your bank accounts and any securities your business can cash out quickly. It doesn't consider:

- inventory or accounts receivables (money people owe your business)

- any revenue you're likely to receive

Cash ratio example

Imagine you have $50,000 in cash and $50,000 in stocks. Add them together to get $100,000. Now find the "short-term liabilities" line on your balance sheet. This includes all of your upcoming expenses, like your loan payments, monthly bills, taxes due, and payroll.

- If this number is $250,000, your ratio is: $100,000/$250,000 = 0.4

- If your short-term liabilities are $25,000, your ratio is: $100,000/$25,000 = 4.0

What’s a good cash ratio?

As with all the liquidity ratios, a high ratio indicates that your business can easily cover its expenses. A low ratio reveals that you may have trouble covering your bills – you may need to get your clients to pay your invoices faster.

When to use the cash ratio

As with the other ratios, the cash ratio doesn't reflect every situation your business is facing. If you've just invested lots of cash into a new product line, your cash ratio may be low – but that doesn't necessarily mean your business will suffer. It simply means you've decided to reduce your cash on hand to earn more revenue with your new product.

When you're making decisions about expenses, liquidity ratios can help you judge when you're going too low with your cash on hand.

The cash ratio:

- is easy to calculate

- provides quick insights on a business's cash utilization rates

- shows a realistic ability to cover short-term expenses because it only takes into account cash and cash equivalents, not inventory or other assets

But:

- the cash ratio doesn't include any operating income

- it doesn't take into account how long-term credit with suppliers or accounts receivables cycles affect cash on hand

- it doesn't take consider long-term expenses or challenges

2. Quick (acid test) ratio

The quick ratio measures your company's ability to cover its expenses over the next three months without selling inventory or taking out loans. So how much cash, or near cash, do you have on hand? Can it cover all your payroll, bills, loan payments, and other business essentials over the next three months?

Quick ratio calculation

-calculation-2.1708626946541.png)

Quick ratio liquidity formula Version 1

There are two ways to calculate the quick ratio:

- The first method is to add up your cash, securities (stocks, bonds, etc that you can easily convert to cash), and accounts receivables (the money owed to you). Then divide that by the total of what you owe and have to pay in the next three months.

- The alternative is to start with the total current assets listed on your balance sheet, and then subtract inventory and prepaid expenses. Then divide by your current liabilities.

Both options should lead you to the same ratio.

Quick ratio example

So, if you've got $30,000 in the bank, $15,000 in securities, and $60,000 in costs over the next three months, your quick liquidity ratio is 0.75. That's $30,000 plus $15,000, divided by $60,000.

The quick ratio is also called an acid test ratio because acid tests are quick and easy to do. Your balance sheet should have all the numbers you need to calculate this ratio.

What’s a good quick ratio?

A great target ratio is 1.0. If your acid test ratio is 1.0 that means you have $1 to cover every $1 of expenses. If it's 1.5, you have $1.50 for every upcoming $1 in expenses.

Low ratios, however, mean you might struggle to pay your upcoming bills. A 0.3 ratio means that you have 30 cents for every $1 of bills over the next three months.

When to use the quick ratio

Use this ratio to compare different companies if you're thinking about investing in a new company. You can also use it to compare your business's financial health to other companies in your industry, or to look at your business's liquidity over different periods.

Although you can use this ratio as a quick guide when you're thinking about taking on new expenses, don't use it to assess the long-term health of your company. For instance, you might be sitting on a stack of cash because you’ve had a great launch, but if your product or service doesn't have staying power, you won't be able to maintain your cash flow. The quick ratio isn't going to show you that.

The quick ratio:

- is easy to calculate

- gives you a good idea of whether you can cover your expenses over the short term

- helps you compare differences in cash flow between periods, so you can plan ahead for shortages

- lets you see liquidity to determine if you can afford more expenses or investments

But:

- the quick ratio doesn't take operating income into account

- it only considers a short-term (three-month) period

- it’s tricky to estimate whether you have lots of marketable securities during times of economic stability, or if you have lots of volatile stocks that change value quickly

- the quick ratio may be inaccurate if you overstate the value of your accounts receivables – be realistic about the percentage of these bills that won't get paid

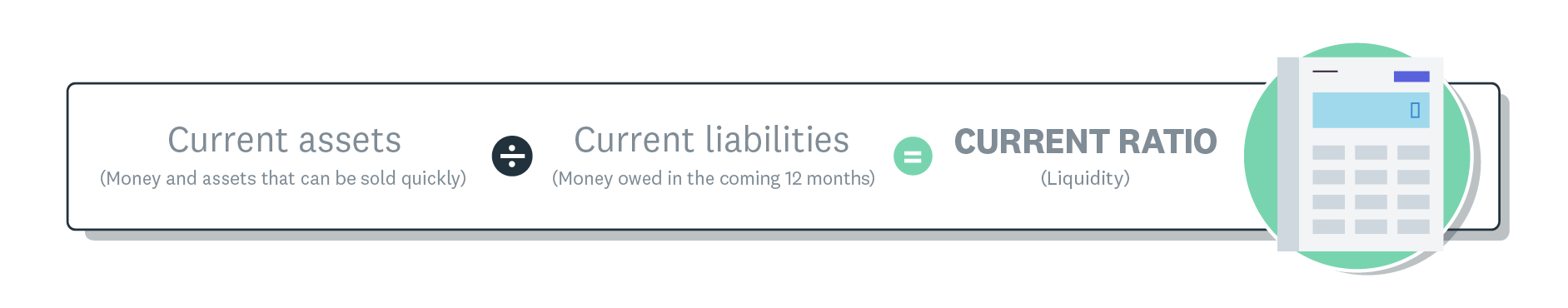

3. Current (working capital) ratio

The current ratio is your current assets divided by your current liabilities. It's called the "working capital" ratio because it shows whether or not you have enough working capital to cover your business's expenses over the next 12 months.

Current ratio calculation

Current ratio liquidity formula

You can find the numbers for this calculation on your balance sheet. Look for your total current assets near the top of the report and total current liabilities near the middle. Don't worry about your long-term assets or liabilities. You can use our free balance sheet template.

Unlike the quick ratio, the current ratio includes your inventory. It accounts for the inventory based on its value on your balance sheet – typically, this means the cost you paid for the inventory, not the price you're going to sell it for. Note that if your inventory is worth less than it cost (such as out-of-season holiday inventory), you should adjust its value on the balance sheet so you get a more accurate current ratio.

Generally, your current liabilities include all bills due within 12 months or less. But keep in mind that the way you do your bookkeeping affects how your liabilities appear on your balance sheet. For instance, if you don't record monthly bills until they go through your bank account they won't appear on your balance sheet, and you therefore won't be able to calculate this ratio easily. An accountant or the support team for your bookkeeping software can help you set up your books so you can calculate this ratio.

Current ratio example

Say you have $25,000 in inventory, $30,000 in your bank account, $10,000 in accounts receivables, $5,000 in prepaid expenses, and $2,000 in short-term investments.

When you add up these numbers, you get $72,000. Cheat code: the balance sheet groups all these assets together in your current assets section, so you don't have to add them up. The total will be labeled as "current assets" on your balance sheet.

Now, find the current liabilities on your balance sheet. This section includes accounts payable, payroll, sales tax, income tax payable, and short-term loans. If your short-term liabilities add up to $100,000, your ratio is 0.72. On the other hand, if your short-term liabilities are $72,000, you have a ratio of 1.0. As your bills get lower (in relation to your short-term assets), your ratio gets higher, meaning you have plenty of money to cover costs.

What’s a good current ratio?

In most cases, you want to aim for a ratio of about 1.5 to 2.0. If your ratio is too low, your expenses are too high and/or you don't have enough cash on hand. If you have a low month of sales, you may struggle to pay your bills.

When to use the current ratio

You can use the current ratio to make decisions about your expenses and cash on hand. For instance, if you have a low working capital ratio, you may need to cut expenses. A low ratio also indicates that if you're buying equipment, you probably shouldn't use your cash on hand – consider a loan to spread the cost over time, instead.

On the other hand, if your ratio is 3.0 or higher, you may be missing out on opportunities – you probably have cash, investments, or inventory lying around that should be reinvested into growing the company.

While this ratio is useful, it's not the only number you need to consider. Don't rely on this ratio to assess your ability to cover your short-term bills if you run a seasonal business. And keep in mind that this ratio really only looks at your current assets and liabilities; it doesn't take into account the long-term profitability of your business, the types of loans you have, or other factors that contribute to your business.

The current ratio:

- is easy to calculate – it requires just two numbers from the balance sheet

- allows business owners to quickly assess cash flow issues

- is helpful for assessing your ability to cover expenses

- can help you identify when you need to take out loans

- can help you identify when you should think about expanding or investing

But:

- because the current ratio only uses two numbers, it is easily skewed when one of those numbers changes for any reason

- it hides seasonal trends and doesn't reflect seasonal cash flow issues

- it only shows short-term financial health, and doesn't take into account future challenges (beyond 12 months)

- it doesn't show insights on the company's long-term financial health

- it lacks insights into the business's loans and profitability

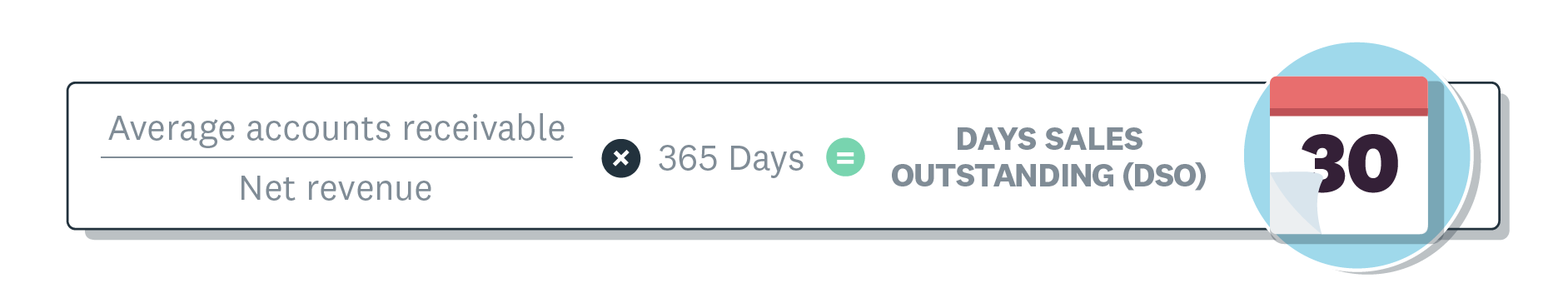

Another metric for liquidity: Days sales outstanding

This ratio may also help you, depending on your industry and the way you operate your business.

Days sales outstanding is the average number of days it takes you to get paid after a sale. To calculate it, divide your average accounts receivables by your revenue per day. If your number is too high, figure out how to get your clients to pay you faster because they're tying up your cash.

The days sales outstanding formula

Using liquidity ratios

Whichever liquidity ratio you choose, you should only calculate it once a month – ideally at the same time each month as the ratio can change depending on where the business is in its billing cycle. And remember to consider the trend of the ratio, not just the moment in time.

Use the lists above to remember what liquidity ratios are good at telling you, and what they’re not good at telling you. Keep in mind the limitations of each number as you look at it. And while you may now know what liquidity ratios are, it’s a good idea to work with a financial advisor on matters like these. The stakes are high.

Liquidity ratios should also be analyzed alongside other financial ratios such as solvency and efficiency for a fuller picture of business health.

How to improve liquidity

If you’re concerned about your liquidity, you can take steps to improve it:

- Use accounting software like Xero to speed up invoicing. The right software makes sending invoices and receiving payments much easier and more efficient. This leads to better cash flow, too.

- Improve your accounts receivable by offering discounts or other incentives for early payments. Also, send automated reminders so payments don’t slip through the cracks.

- Smarten up your accounts payable by negotiating favorable payment terms with suppliers and finding the most cost-effective suppliers possible. Use extended payment terms where it makes sense, but pay on time to avoid late fees and unnecessary financing costs. Cut all non-essential or discretionary spending.

- Monitor and reduce your operating costs. Lease or rent equipment as appropriate to maintain cash reserves. Sell off unproductive assets to improve your cash reserves and cash flow.

- Manage your inventory by keeping levels at industry standards and use just-in-time inventory ordering so your cash isn’t tied up.

- Increase sales through expanding your customer base or introducing new products or services without increasing your operating costs.

- Consider refinancing. You may be better off consolidating expensive short-term lending into lower interest loans, or you may need extra loans during times of growth.

Your accountant can help you make these decisions. Find experienced accountants and bookkeepers in the Xero advisor directory.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.