S corp vs LLC: which structure is right for your business?

Your business structure affects taxes, IRS requirements, and shareholder options. This business structure comparison explains the key differences between S corporations (S corps) and LLCs, including personal liability, management structure, and taxation, so you can choose the right one for your business.

Key takeaways

Key differences between S corps and LLCs

LLCs give you more flexibility in management and ownership, with fewer compliance needs, while an S corp structure has potential tax advantages but has stricter rules on ownership, management, and compliance arrangements.

Tax implications for S corps and LLCs

LLCs and S corps both offer pass-through taxation but differ in the way they must tax and distribute profits. While LLCs pay self-employment taxes on all profits, S corps owners can reduce taxes by paying themselves a reasonable salary and allotting the remaining profits as tax-free distributions. But S corps are subject to stricter IRS requirements and compliance standards.

Pros and cons of S corps and LLCs

LLCs are more straightforward to start and flexible, but all profits pass through to the members who pay self-employment taxes as well as income taxes. This results in higher taxes being paid for LLCs than S corps. S corps have stricter IRS rules than LLCs. But by paying salaries to owners and taking profits as distributions, they can help growing businesses save on taxes.

How to choose the right structure for your business

Consider each structure’s tax and compliance requirements, and your own business plans and requirements. S corps have tax advantages for profitable businesses, while LLCs give you flexibility and simplicity. So look at each structure’s tax and compliance requirements, and your specific business goals and circumstances to make an informed decision.

Table of contents

- What is an LLC?

- What is an S corporation?

- The key differences between LLC and S corp

- Tax implications for S corp vs LLC

- Pros and cons of LLC vs S corp

- Should I choose LLC or S corp for my small business?

- FAQs about S corp vs LLC

What is an LLC?

LLC stands for limited liability company. These business structures define how a business organizes itself and can protect business owners from financial issues. In keeping with this, an LLC separates business from any personal assets, effectively limiting liability for debts to the business, rather than the personal assets of its owners. Therefore, your personal assets are usually safe if the business has financial trouble.

In an LLC, your business income passes through to the members who then report the income on personal tax returns. This helps avoid double taxation which occurs when a business pays taxes at the corporate level but then shareholders also pay taxes on any dividends passed when filing personal tax returns.

What is an S corp?

The S corp is a special tax status designed for small businesses. It has the advantages of a corporation, such as a distinct legal identity and potential tax benefits in a single business structure. And like LLCs, S corps separate business assets from personal ones to protect personal assets.

However, S corps have specific rules and ownership restrictions, which can affect costs and business planning. Our guide explains more about S corps.

The key differences between S corps and LLCs

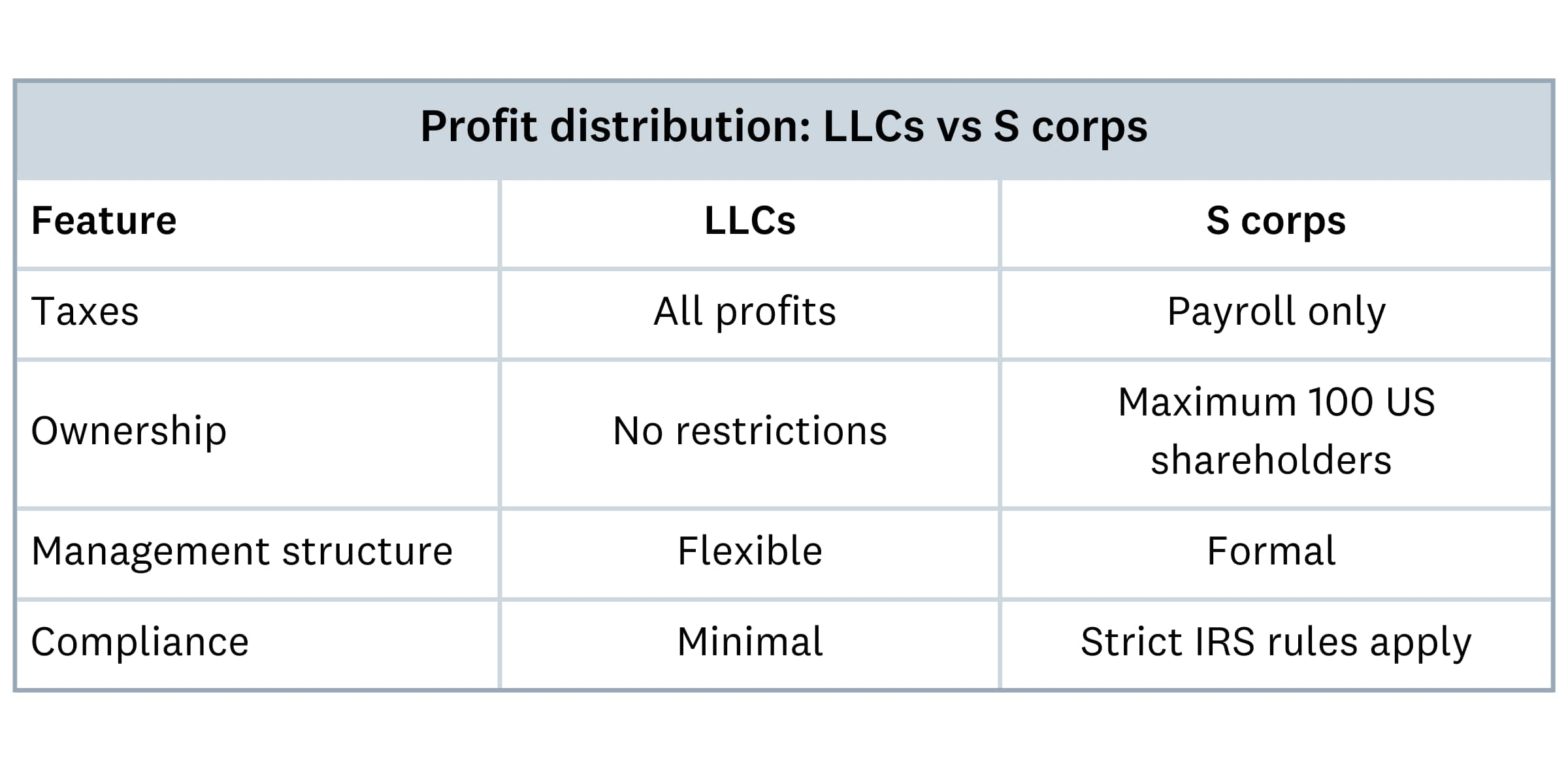

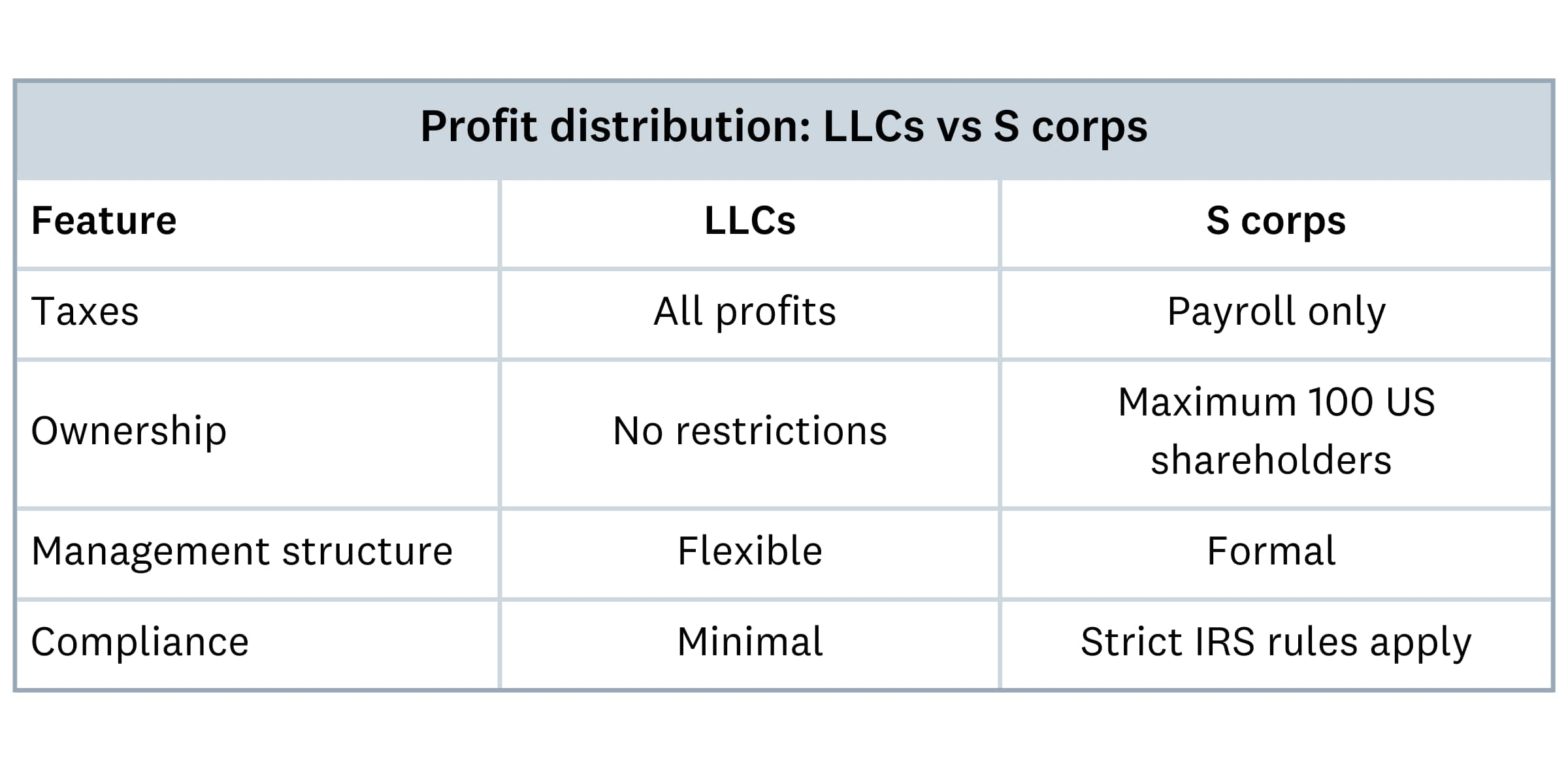

LLCs and S corps differ in ownership and management structure, the taxation and compliance rules they must follow, and how they distribute their profits.

Taxation

This is the main area where S corps and LLCs differ. Here’s a summary of the main differences, but see the next section for more details.

LLC:

The IRS taxes LLCs as pass-through entities. In this case, taxes transfer from the business to an owner's personal tax return, which helps businesses and owners avoid paying corporate tax. Instead, owners pay self-employment taxes on business profits.

S corp owners, however, have more opportunities to minimize their tax bills. While an owner pays themselves a salary (which is taxed as part of the business’s payroll) they can also take profits as distributions, which are exempt from payroll or self-employment taxes. Any distributions that do not exceed the shareholder’s basis are tax free.

Ownership

To the IRS, LLC owners are called members. LLCs can have any number of members, including individuals, corporations, foreign entities, or even other LLCs.

Because S corps are set up like regular companies, their owners are called shareholders. S corps can have up to 100 shareholders, who must be US citizens or residents and are typically individuals. S corps can only have one type of stock as well.

Keep this requirement in mind if you plan to raise money, especially from foreign or corporate investors, as it will affect your business growth plans. However, this restriction does not apply to LLCs.

Management structure

LLCs have two management options, both of which are reasonably informal.

- Member-managed: Owners are directly involved in business decisions and managing daily activities

- Manager-managed: Owners can appoint a manager for daily tasks and decisions

S corps follow a stricter structure. They must have a board of directors and keep detailed financial and business records.

Compliance

LLCs have fewer compliance requirements than S corps. While the U.S. Small Business Administration advises LLC members to keep their operating agreement and business documents up to date, these actions aren’t required for businesses to keep their LLC status. But they need to meet filing requirements at state level and pay any fees on time.

S corps must follow strict IRS requirements to keep their S corp status. They need to:

- Appoint a board of directors

- Hold annual director meetings

- Keep their corporate records up to date, including yearly annual reports and meeting minutes

Profit distribution

LLCs can distribute profits and losses as they wish. An owner who owns 20% of the business can receive 80% of the profits.

An S corp, however, must distribute profits and losses in proportion to its ownership – for example, a person who owns 50% of the business receives 50% of the profits.

Here's a table showing the differences between the two structures.

S corp vs LLC taxes: the differences

There are significant differences in the ways LLCs and S corps are taxed. Although both LLC and S corp structures allow pass-through taxation (where the business passes taxes to shareholders), they calculate profits and taxes differently.

LLC taxation

You report LLC profits on your personal tax return. All income you earn is subject to an LLC self-employment tax (levied at 15.3% in 2024).

You can also choose to have the IRS tax your LLC as an S corp or a C corp, which allows you to distribute a portion of your profits as dividends. These distributions are exempt from self-employment tax, which can lower your tax bill overall. If the LLC only has one member, then it is called a single member LLC and considered disregarded for federal purposes. This means all profit and losses are only reported on personal income tax returns instead of having any business tax filings. There may be different state reporting requirements.

S corp taxation

S corps can share profits with shareholders tax free – a tax advantage over LLCs. While it is tax free for the S corp, the profits reported as distributions are only taxable if the distributions exceed the shareholder’s basis.

An S corp owner must pay themselves an employee salary that is ‘reasonable’ for their industry. Although this salary is subject to payroll tax, owners can then distribute the remaining profits to shareholders in the form of tax free dividends.

How S corps and LLCs calculate self-employment taxes

S corp and LLC business structure taxes are different. While LLC owners pay self-employment taxes on all profits, S-corp owners only pay payroll taxes on their salaries and are not subject to self-employment tax.

Here’s an example to illustrate the difference.

Imagine you made $100,000 this year. Under an LLC, this entire amount is taxable but on the member level on their personal taxes: the LLC members are subject to self-employment tax of 15.3% (as of 2024) on the entire amount.

But in an S corp, you take a $60,000 annual salary, which is subject to payroll taxes, while the remaining $40,000 can be distributed tax-free on the S corp level. These distributions are not subject to taxes on employee wages but are instead distributed to shareholders. Any distributions are treated as a reduction to the shareholder’s basis. Any distributions that exceed the shareholder’s basis is treated as capital gains income on the shareholder’s personal return

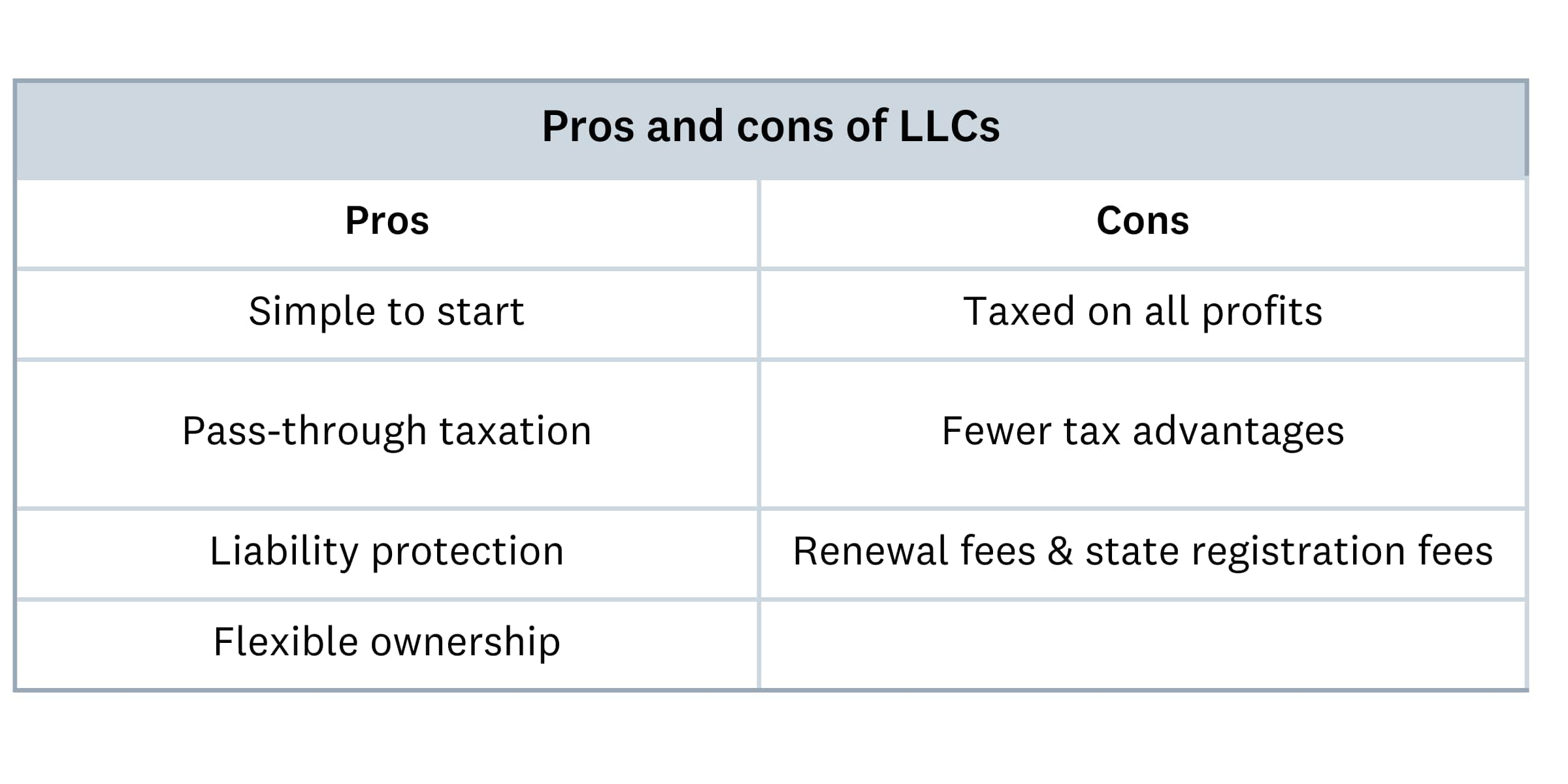

LLC vs S corp pros and cons

Pros and cons of LLCs

Pros:

- LLCs are simple to start and maintain, with few formalities

- Pass-through taxation simplifies your tax calculations and reporting

- You’re protected from personal liability

- Single-member LLCs are treated as disregarded entities and reported on individual tax returns which allows for liability protection without the extra federal filing of an LLC tax return

Cons:

- All profits are subject to self-employment taxes

- There are fewer tax advantages compared with an S corp

- You’ll have to pay renewal fees and state registration fees

Pros and cons of S corps

Pros:

- S corp owners have opportunities to make tax savings

- A pass-through taxation structure

- You also have personal liability protection as an owner

Cons:

- An S corp must be based in and operate in the US

- Ownership is limited to 100 US-based shareholders

- There’s plenty of administrative work, like record keeping and compulsory annual meetings

- You can lose S-corp status if you don’t continue to meet the IRS guidelines

Should I choose LLC or S corp for my small business?

Your choice depends on your situation and the needs of your business. So evaluate your business goals, and ask a tax professional for advice.

Here’s some guidance on the specifics, too.

Compare tax implications

If tax savings matter to you, an S corp can provide more savings for profitable businesses, as long as you meet the S corp tax rules.

Check compliance requirements and admin costs

If you’re just starting out, for example, and you value simplicity and lower costs, an LLC structure might be a better bet. S corps must follow stricter IRS rules than LLCs, and you’ll likely face ongoing costs and administrative tasks to meet S corp requirements.

Understand the differences in ownership requirements

If you’re planning to grow your business, make sure you’re aware of the S corp shareholder requirements, and potential restrictions on raising capital from investors outside the US. S corp shareholders are limited to domestic individuals, certain trusts, and estates. S corps are not allowed to have shareholders that are partnerships, corporations, or other nonresident entities

Consider your business growth and plans

If you’ve been in business for a few years and want to expand, consider becoming an S corp for its tax benefits. Just make sureyour business earns enough to pay you and your employee's standard salaries. But an LLC may be a better option if you’re a solopreneur who likes to keep things small and flexible.

Whichever business structure you choose, Xero accounting software can help you manage your business finances and streamline your compliance work.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.